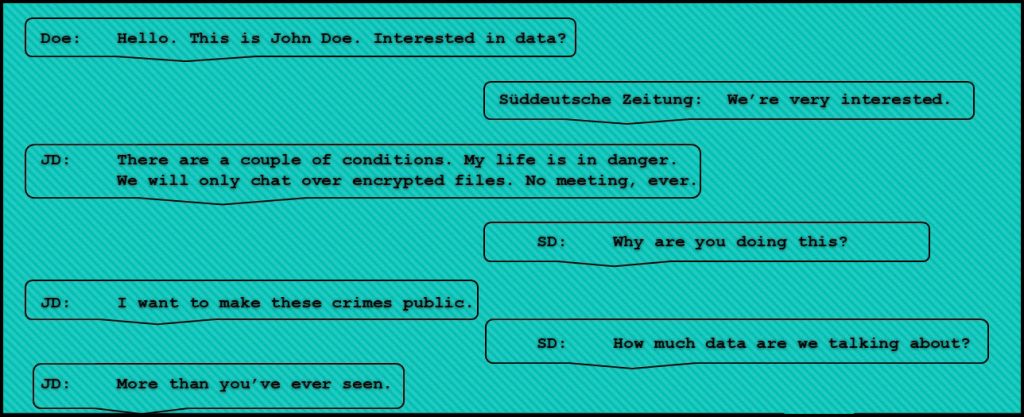

Over a year ago, an anonymous “John Doe” sent an encrypted message to a newspaper in Germany called Süddeutsche Zeitung. The conversation unfolded like this:

That 2014 cache of data, the equivalent to about 38,000 average-sized books, make up what became known as the Panama Papers.

It’s a trove of documents obtained from the files of a Panamanian law firm called Mossack Fonseca, which helped create shell companies and other complex financial instruments in order to assist companies and individuals to evade paying tax in their home countries.

Journalists from nearly 100 news outlets around the world in a collaboration called the International Consortium of Investigative Journalists (ICIJ) worked together nonstop for months under tight security and complete secrecy.

At 2PM Eastern on April 2, 2016, Süddeutsche Zeitung broke the news, and then one by one, the collaborative lit up their front pages with the story.

Within only 8 months, governments around the world were investigating over 8,500 individuals and had already recouped more than $110 million in unpaid taxes. The avalanche of repercussions included the ouster of the prime ministers of two countries, Iceland and Pakistan, as well as the industry minister in Spain. Hundreds, if not thousands, of investigations are still ongoing.

The Panama Papers aren’t just some nebulous thing that you can read about but not have access to. There’s an actual database where anyone can search for people and companies to see if they appeared in the Panama Papers as well as two previous leaks called the Offshore Leaks and the Bahamas Leaks. That database is here: https://offshoreleaks.icij.org/

And you know, for due diligence purposes, it’s really not a bad idea to check it. When you log into the database, a popup reminds you that, just because someone appears in the database, it doesn’t mean they’re necessarily a bad guy. But that database will help you to know.

But that’s all so last year.

As you may have heard, a new data set has been added to that online, searchable, database.

Earlier this year, another anonymous leaker uploaded data to Süddeutsche Zeitung, and as with the Panama Papers leak, SZ contacted the ICIJ again to work together with them to report on the data.

This new data set is called the Paradise Papers, mainly because the primary source of information comes from a 119-year old company called Appleby which is based in balmy Bermuda.

Appleby works with corporations and wealthy individuals to help them reduce taxes; hide ownership of assets like companies, yachts, planes, real estate, and art; and/or set up offshore trusts to hold large bank accounts.

What are the Paradise Papers?

They are a cache of about 3.4 million documents; around 1,400 gigs of data. The documents came from four sources:

- Offshore legal service provider Appleby

- A company that spun off from Appleby in 2016 called Estera

- Corporate registries from 19 jurisdictions, mostly in the Caribbean

- A Singapore-based international trust and corporate services provider called Asiaciti Trust which says it helps clients to “accumulate and preserve wealth from the ravages of litigation, political upheavals and family breakups.”

What do they contain?

Client information – on companies as well as individuals – and their off-shore accounts, shell corporations, and trusts they created in order to avoid paying tax in their home countries. Named in the documents include multinationals like Apple, Facebook and Twitter; three former Canadian prime ministers and a titanic shipload of world ministers; members of parliament of several countries; secretaries (as in Commerce and State); royalty; sports figures; business titans; and many more.

It’s going to be many, many months before all of this new data is sorted through (people are still mining the year-old Panama Papers for information), but the continuous additions to the online database and the ongoing stream of articles will help answer many questions for prospect research, like:

Just how pervasive is offshoring?

It looks like it’s pretty common. Or, in the words of a Harvard Kennedy School of Government study, “the rich are a lot richer than we thought.” Over 80% of offshore wealth is held by the top 0.1% wealthiest families.

And you don’t need to be a billionaire to be in the sweet spot for offshore tax avoidance. Jeffrey Winters, a professor of political science at Northwestern University and the author of the book, Oligarchy, said in an interview in The Atlantic, “individuals start being able to afford Mossack Fonseca-level wealth defense once their annual earnings (from both work and assets combined) cross a threshold of about $3 million to $5 million.”

That’s a lot of our major donor prospects. It’s certainly something to think about now every time we try to estimate a prospect’s capacity to give.

For your further reading/listening pleasure

The Atlantic: “Are Shell Companies Useful for People Who Aren’t Ludicrously Rich?” by Joe Pinsker (April 8, 2016) https://www.theatlantic.com/business/archive/2016/04/how-rich-do-you-have-to-be-for-a-shell-company-to-be-useful/477384/

BBC: “The Paradise Papers; Everything you need to know about the leak.” (Nov 7, 2017). http://www.bbc.com/news/world-41880153. Includes a video: “How to hide your cash offshore.”

A primer on offshoring from CPA tax expert Ken Boyd: “Tax Avoidance By The Numbers; The Paradise Papers.” Helpful facts, figures, and infographics.

International Consortium of Investigative Journalists (ICIJ): “Inside the Secret World of Offshore Mega-Trusts” by Spencer Woodman (Nov. 7, 2017) https://www.icij.org/investigations/paradise-papers/secret-world-offshore-mega-trusts/. Offers a case study of billionaire James Simons and his new offshore philanthropic holding.

ICIJ: “Habits of The Rich; Offshore Gurus Help Rich Avoid Taxes on Jets and Yachts” by Ryan Chittum and Juliette Garside (Nov. 6, 2017). https://www.icij.org/investigations/paradise-papers/offshore-gurus-help-rich-avoid-taxes-jets-yachts/

Podcast: NPR/WBUR On Point: “Paradise Papers Roil the World’s Elite” (Nov. 7, 2017). Tom Ashbrook interviews Gerard Ryle, director of the International Consortium of Investigative Journalists; Jesse Drucker, reporter for the New York Times; and Sasha Chavkin, reporter, International Consortium of Investigative Journalists. http://www.wbur.org/onpoint/2017/11/07/paradise-papers-roil-the-worlds-elite

SmartAsset: “What is a Shell Company?” by Amanda Dixon (May 27, 2016) https://smartasset.com/investing/what-is-a-shell-company. The basics, and more, about shell companies.

SmartAsset: “All About Offshore Banking” by Amelia Josephson (Dec. 20, 2016) https://smartasset.com/checking-account/all-about-offshore-banking