The 2015 Capgemini and RBC Wealth Management World Wealth Report is out! Every spring, it makes for fascinating reading for those of us in fundraising, and for financial advisors and wealth managers working with high net worth individuals (HNWI).

Each year they survey wealthy people worldwide for this report, and this year over 5,100 HNWIs in 23 countries were surveyed.

It’s an annual ritual for me to print it out, pop the cap off the yellow highlighter, make a big mug of tea, and have a great time hmmm!ing and ooooh!ing as I dig through it. Here are the points that are yellow and marked with sticky notes on my copy this year that I thought you’d find interesting, too:

#1 HNWI care deeply about social impact

According to the report, 92% of HNWIs surveyed say that they feel that driving social impact is important. Their concern, however, is that they don’t have access to great advice on what to do about it. Where (and how) should they be philanthropic? Where can they get good advice? The report advises that wealth managers should become more savvy about charitable giving opportunities (personal foundations, donor advised funds, and community foundations, to name a few) and the role that family offices can play in helping HNWIs direct their social impact opportunities.

What does that mean for the fundraising sector (or for your organization)? As social impact experts, we have an opportunity to engage with wealth managers and family office advisors to educate them on smart and efficient ways to help their clients.

#2 China and the US drove growth in HNWI numbers, but India’s a rocket

Where are the international fundraising opportunities? The US and China comfortably drove more than 50% of HNWI growth globally, and the US is still the leader in terms of raw numbers (with 4.4 million HNWI), but India was the fastest growing HNW market last year, climbing 26% and jumping five places to its current rank of 11th place.

For the Ultra HNW population (those with over $30 million in assets), Latin America accounts for 31% of UHNWI wealth globally, significantly more than the 22% for Asia Pacific and 23% for North America. Brazil accounts for 57% of all Latin American UHNW holders.

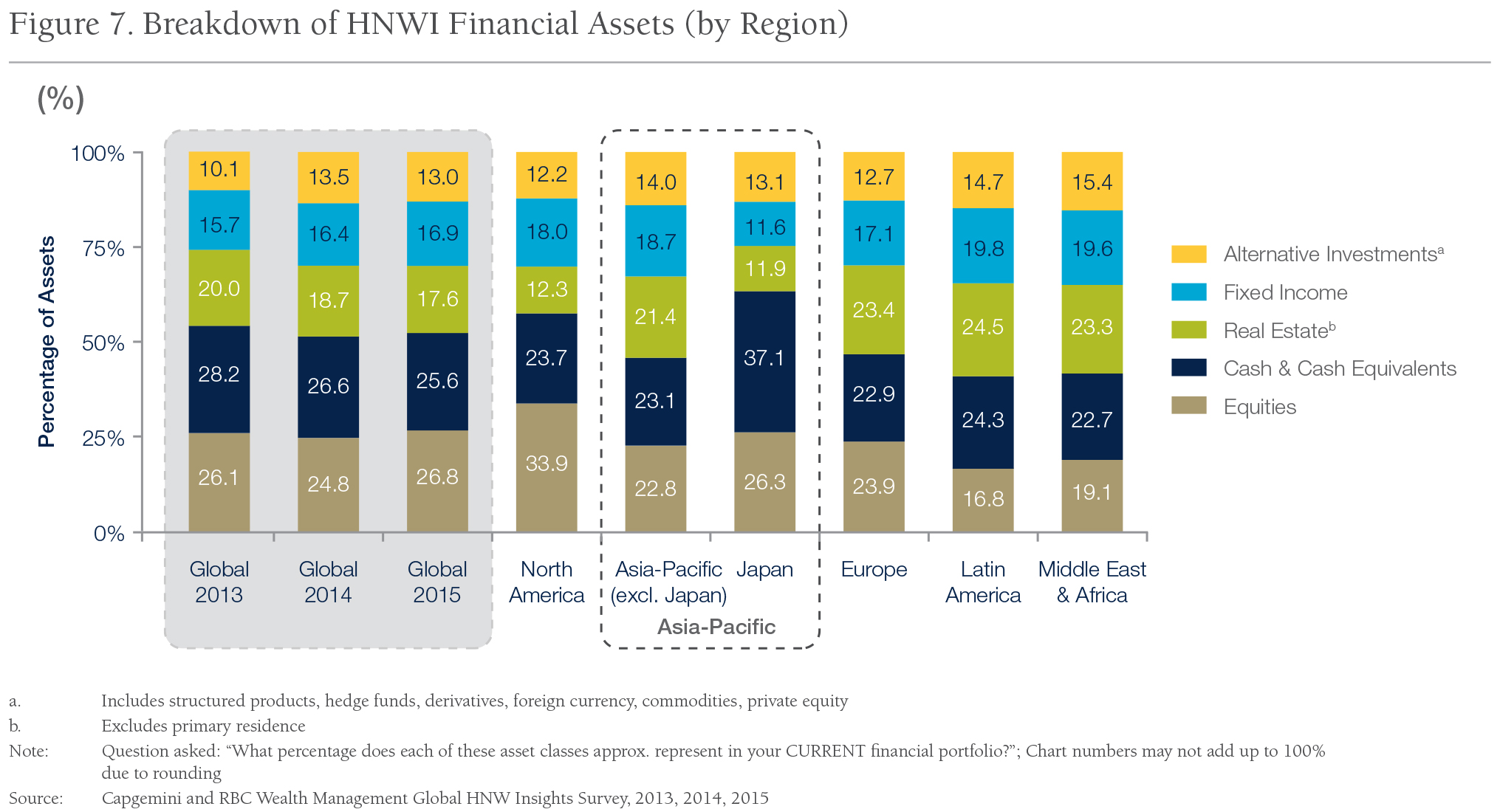

#3 HNWI across the world hold their assets in very different ways

Obviously every person is unique, but these trends are interesting and helpful to us in prospect research. In trying to estimate what someone’s capacity to give might be, knowing their real estate holdings, for example, might give me a clue to what the rest of their portfolio looks like as a ratio. As a fundraiser, it might make more sense to discuss a gift of stock from someone in the US, but a donor in Brazil might be more inclined to make a gift from cash or real estate.

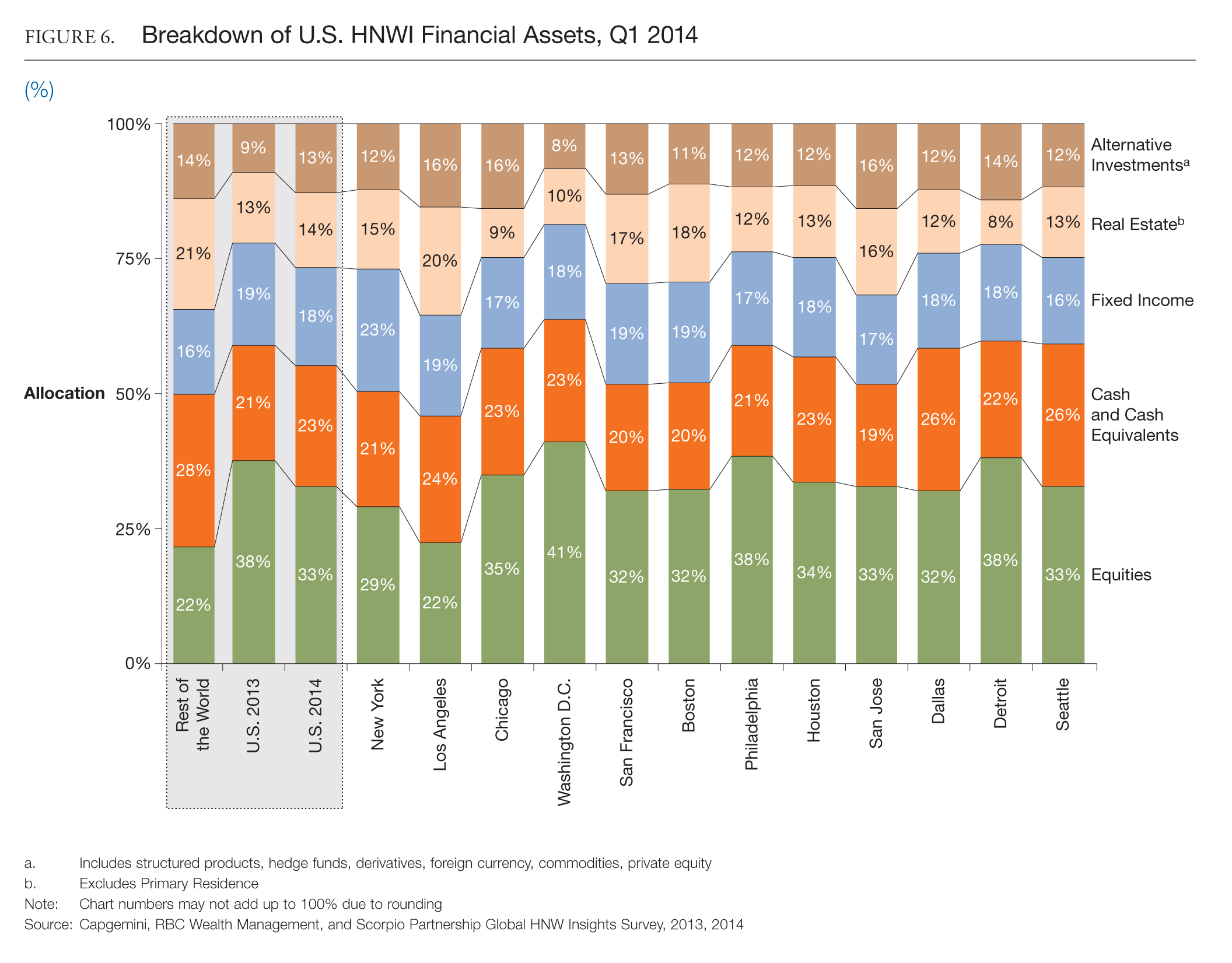

Within the US, we can look at the breakdown of assets held by HNWI in different cities, from the U.S. Wealth Report 2014 published by Capgemini and RBC Wealth Management last year. This can help us as researchers get even closer to extrapolating an individual’s portfolio:

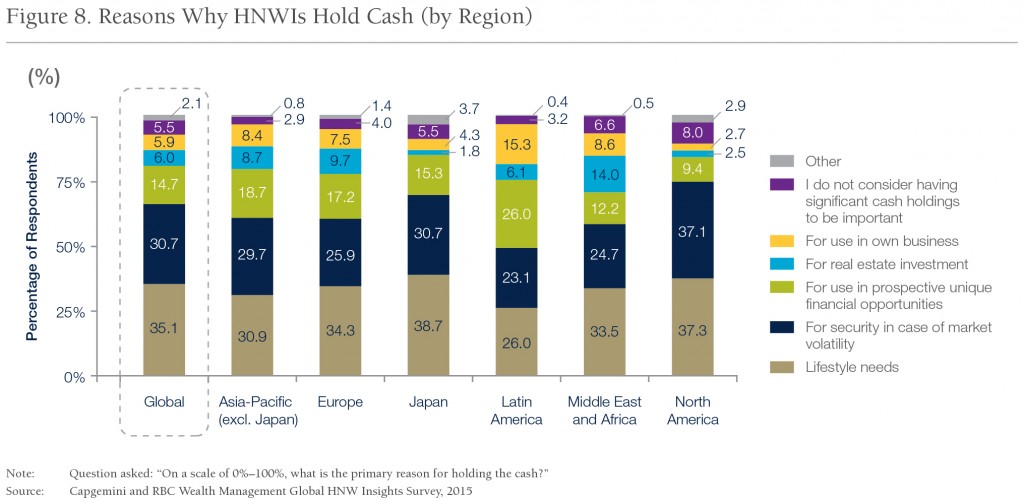

#4 What are their cash holdings used for?

#4 What are their cash holdings used for?

As you can see, all but Latin American HNWI are largely living off their cash (as opposed to their equities or their fixed income) or stockpiling it to hedge the market (“mattressing” money, as my financial planner likes to call it). That lime-green segment (for “unique financial opportunities”) is what I imagine has some chunk of it earmarked to major philanthropy.

#5 High Net Worth Individuals love credit

This got a big hmmmm!:

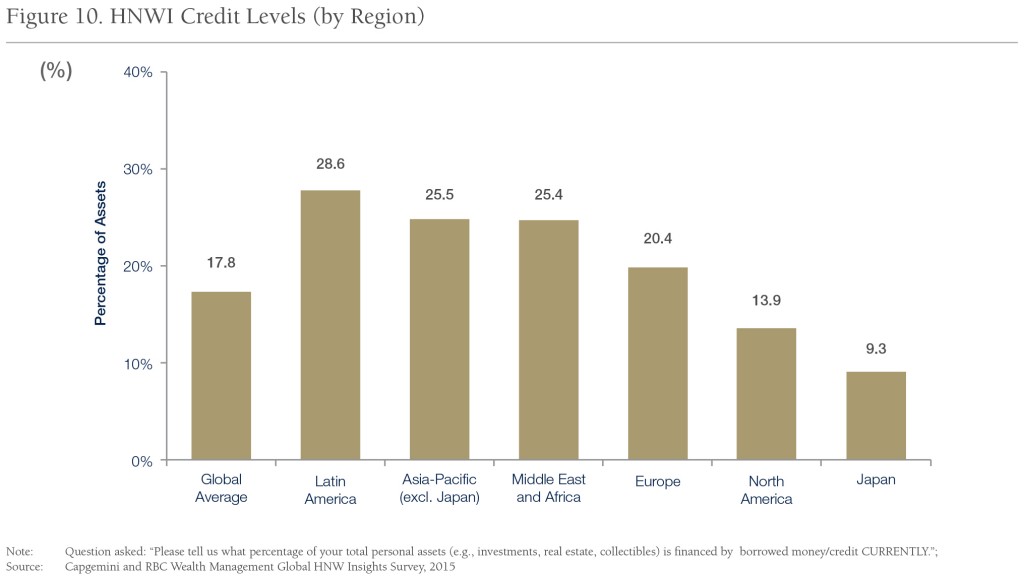

The Capgemini and RBC Wealth Management report stated that “Credit figures prominently in HNWI portfolios, and its availability [from asset management companies] is a big selling point for some HNWIs, although demand varies by region and demographic. For the under 40, wealthier, and emerging market HNWIs, credit is a must-have. HNWIs are mostly turning to credit as leverage for investment opportunities or to invest in real estate.”

Credit? What’s up with that? HNWIs are making decisions (to a certain degree) about which wealth management company they want to work with based on the availability of credit from that company.

When you get to a certain financial level, you need less and less of your own money to invest in other things (like commercial buildings, or big hunks of stock), and you can borrow money (from banks or other financial institutions) to leverage a small bit of your own assets to make a bigger investment. Younger HNWIs are clearly savvy about using other people’s money to finance their continuing success.

Globally, nearly 18% of a HNWI’s portfolio is made up of credit. The question asked was “Please tell us what percentage of your total personal assets (e.g. investments, real estate, collectibles) is financed by borrowed money/credit CURRENTLY.”

Here was their answer:

So, if you want to take debt into account when researching a HNWI, you can use that figure as a guide.

Those are my top 5 takeaways from this year’s World Wealth Report. If you read the report, what else did you find fascinating?

Images courtesy of Capgemini and used with permission. A fun, content-rich interactive website can be found here.