It’s giving report time of the year!

I imagine you’ve had a look at the Giving USA statistics by now and/or heard the muttering, garment-rending, and lamentations about the decline in giving in America and what it means for the future of philanthropy.

I can easily imagine that putting Giving USA together is a lot of work. I can’t imagine how many countless hours there are to check and re-check the numbers before publishing. I’d like to imagine a Giving USA that can count more things, better, and sooner, but that’s a tough ask for lots of reasons.

I want to be very clear right up front that this is NOT a bash-Giving USA article. I’m asking you to consider that the report is one data point of many. Just like prospect research involves Lexis Nexis and Dun & Bradstreet and talking 1:1 with a donor and an article in the Chronicle, Giving USA is one of many sources that you could study as you consider how to parse out giving in the USA.

You can’t count what you don’t have.

But, despite solid methodology, like everything in the world Giving USA is imperfect because they just don’t have access to all of the information. They’re doing the best they can with the information they have in front of them.

COUNTING MORE

What isn’t in front of them is the individualized amounts donated collectively via giving circles.

Or GoFundMe.

KickStarter.

Patreon.

Direct giving from one person to another. Venmo. Zelle.

What about microloans and other charitable investments?

Buying food and donating that instead of the cash?

Countless countless countless volunteer hours, which can be even more valuable than gold.

Anything not directly given to a 501(c)(3) won’t be counted. (But more on that in a minute).

Let’s say you could even get totals or gift details from all of these sources individually. Who’s going to take the time to parse out designations on all of those gifts so they can be accurately categorized and reported on?

COUNTING BETTER

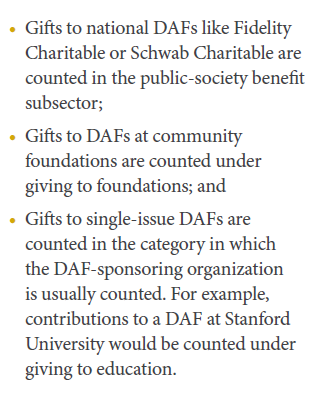

Let’s take a look at how Giving USA categorizes gifts to donor advised fund sponsors. Remember I said that anything not given directly to a nonprofit won’t be counted? Well, besides that, sometimes it’s not counted accurately. Here’s Giving USA on how they categorize gifts that set up a DAF.

Say someone donates their $5,000 to a national sponsor (like Fidelity Charitable, Schwab Charitable, or Vanguard Charitable – which are nonprofits) to set up a donor advised fund. Giving USA will count that donation under Public-Society Benefit.

If the donor sets up a DAF account at a community foundation (like the Silicon Valley Community Foundation, the Tulsa Community Foundation, or the Chicago Community Trust), that gift is designated by Giving USA as going to a foundation.

If a donor creates a DAF account at a single-issue sponsor (like a Jewish Federation or Rotary International, which sponsors DAFs), then the gift is designated by Giving USA as whatever that organization’s National Taxonomy of Exempt Entities (NTEE) code is. (“Religion Related” and “International, Foreign Affairs and National Security” respectively in this example).

So to illustrate: Let’s say this year I make a million dollar donation to set up a DAF at the Cape Cod Community Foundation. (hey, a girl can dream). That donation is categorized by Giving USA as giving to a foundation. Next year I’ll grant the whole million in equal parts to my university, an animal shelter, an art museum, an environmental organization, and to a food security nonprofit. But those grant designations are not tracked; the money’s been counted as originally gifted – I gave to the NTEE designation “foundations.”

Giving USA doesn’t have access to grant records from every DAF sponsor in the US (of which there are over 1,000). If they did, they could parse out the designation for each grant – or ask each sponsor to categorize each grant, designated to the right NTEE code.

But again, who’s going to take the time to parse out designations on all of those gifts so they can be accurately categorized and reported on? Hello AI? Have I got a job for you!

COUNTING SOONER

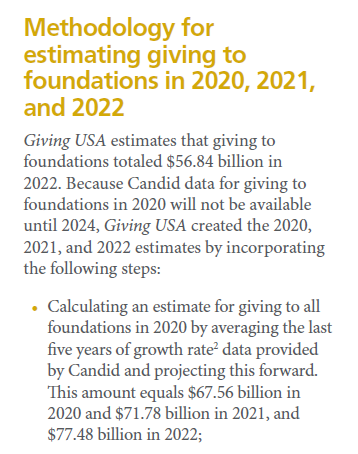

In your everyday research, you may have noticed that the IRS is, ahem, kind of slow in posting 990s. In a normal year, information that’s brand-newly-uploaded is from a foundation’s tax return from two years ago. The IRS is so behind now that they’re lagging even further behind that “speed” now.

What that means is that all of the resources that count on IRS data to estimate giving in America from foundations, including Giving USA, are consulting data that is at least two years old. Giving USA says that we won’t know what happened in foundation philanthropic giving in 2020 for sure until 2024:

You can’t turn on your phone or your computer or your radio or television without seeing/hearing another bit about how AI is taking over. How data-driven business and data-driven philanthropy are already here, now.

But for goodness sake, we can’t get accurate information from 2021, much less last year! I’d love for this to be a problem AI could actually solve – a real AI For Good hero journey instead of the Hal dystopian outlook.

So what am I trying to say here?

- Yes, giving may have gone down. But it might not have. It might just be … different than it was 5 or 10 years ago.

- Life’s coming at us fast. We just might not have the technological ability (now? yet? ever?) to be able to accurately count what counts.

- Giving USA is just one report. It’s good and there are others that are good, too. We may need to piece information together going forward. For example, to track recent giving totals and designations in donor advised funds, check out these brand-new up-to-the minute reports by Fidelity Charitable, Schwab Charitable, and Vanguard Charitable which list how much they gave away last year, broken out by their DAF-holders’ giving interest areas.