We say that we’re always looking for innovation in fundraising … but that it has to happen carefully because there’s not a lot of wiggle room at most nonprofits for a whole lot of risk-taking.

We say that we’re always looking for innovation in fundraising … but that it has to happen carefully because there’s not a lot of wiggle room at most nonprofits for a whole lot of risk-taking.

We lament our increasing dependence on a smaller number of larger gifts from major donors… and yet we have to strive for increasing the number of major donors because that’s where the money is. It’s just more efficient, and we have to be careful with time and resources.

We’re experiencing a sharp drop in the number of smaller, sustaining donations as an industry…nonprofits struggle to engage with and retain foundational supporters.

All of these things hit me today as I was reading about a type of support called Quadratic Funding. Now, you need to understand that one of my most-beloved, rattiest t-shirts (that I will never send to Goodwill) says this:

In my job I have to math, but I don’t love it.

Still, this Quadratic Funding business makes a lot of sense to me because it takes the very limitations that we’re experiencing in fundraising right now and turns them into positive attributes.

Have you ever been in a store where, when you check out they give you a token? You’re supposed to take the token and drop it in one of a few labled containers, and whichever container has the most tokens by x date is the nonprofit that the store will fund at the end of the year. You vote with your token and one nonprofit “wins.”

Well, this is sort of like that, except every nonprofit or project wins.

Here’s how it works within one nonprofit

Let’s say your nonprofit has four projects that need funding. Nothing too risk-take-y like a building or critical-care unit. But projects that need to get done and that you can write or tell an engaging story or create a video about.

You start with a large donation that serves as the matching fund. (So, you’re still working with major donations, yes, but from perhaps a different type of major donor. It could be an individual donor or perhaps a collection of DAF donors interested in social impact funding.)

You tell the stories and build enthusiasm for the four projects. You invite gifts at all levels. People get behind their favorite project, and hopefully inspire others to get behind it, too.

The more gifts each project gets, the larger proportion of the matching gift fund it gets.

Wait, what?

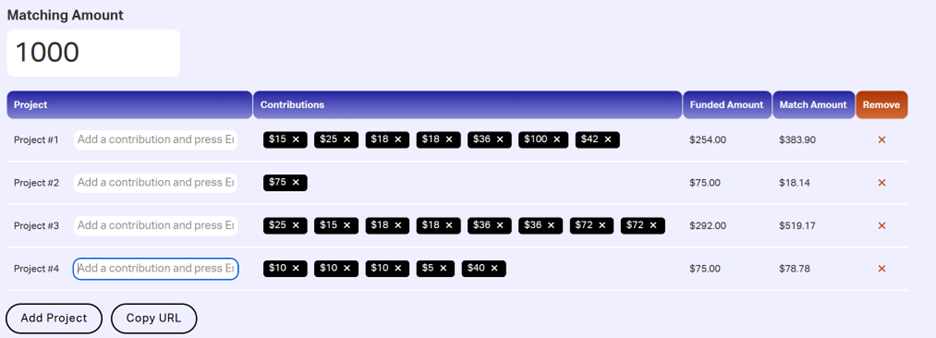

So for example, let’s say the matching gift fund is $1,000 and we’ve got 4 projects to raise money for. Look at this table of gifts:

You can see that Projects 2 and 4 got the same total amount of support: $75.

Project 2 only got one gift of $75, so its match was $18.14.

Project 4 got five gifts for a total of $75, so its match was $78.78. It had more crowd support, so it got a much larger match amount.

Every project still wins, but the ones that have more interest and more enthusiasm for them win …bigger.

The mathy part

This concept of quadratic voting has been around for awhile, mostly in economics circles but also for political voting as well. (More here in Wikipedia for background).

But where it’s gained traction in philanthropy is from the support it’s gotten from Vitalik Buterin (the Ethereum cryptocurrency co-founder) in collaboration with Zoë Hitzig (Junior Fellow, Harvard Society of Fellows) and E. Glen Weyl (economist, Microsoft Research New England) who proposed the use of quadratic funding using crypto in their article “A Flexible Design for Funding Public Goods”.

(In fact, quadratic funding has been used in the Gitcoin Grants Initiative to distribute more than $60,000,000 to over 3,000 open-source software development projects in the past few years. Which is not nothing.)

How is the sausage made?

Apparently quadratic funding is calculated like this: you take the square root of the amount of each gift by each donor to a particular project. The sum of these square roots is then squared to obtain the voting power for that project.

Back to the real world

Recently, the online community foundation Endaoment started an initiative in collaboration with Gitcoin that uses quadratic funding and, while the actual methodology may be somewhat ponderous, what they’re doing is suuuper interesting.

For example, you can go to its funding page and watch distributions from peoples’ crypto wallets, credit cards, DAFs and more happen in real time. Those gifts get matched from Endaoment’s Universal Impact Pool on a timed payout, which you can see as a countdown clock.

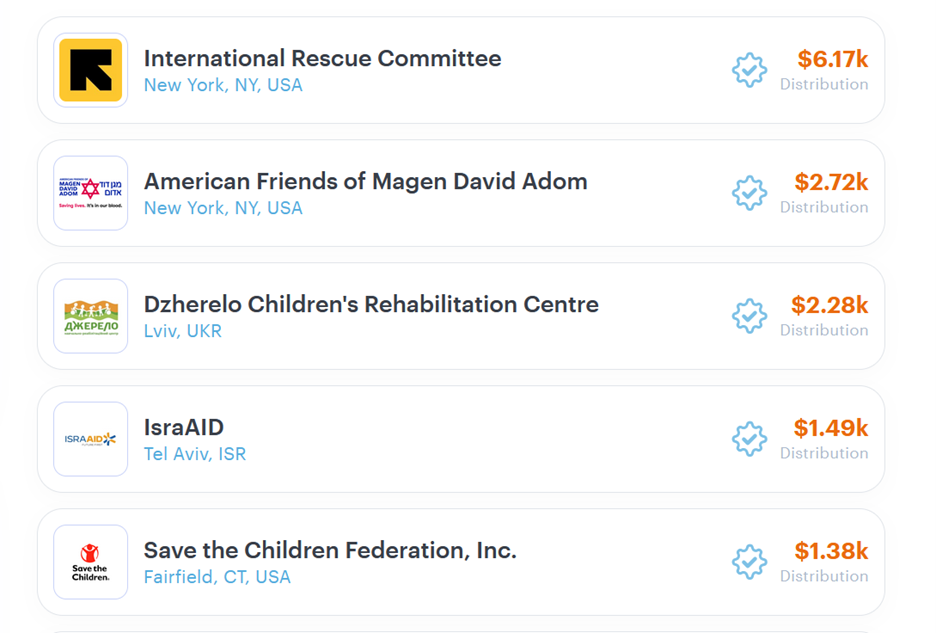

When I checked on Monday, the top nonprofits being supported were:

The amounts will change on a regular basis as more people donate and until the final distribution is made. As you can see, current events are elevating causes and nonprofits that are in the news, and as you look back on past funding cycles, the nonprofits that received funding were likewise in the spotlight.

What does this mean for your nonprofit?

A nonprofit doesn’t have to be on the front lines of current events to take advantage of quadratic funding. Even a small nonprofit can create a buzz from 1) an impact fund, 2) a few much-needed projects, and 3) great stories that inspire a new kind of giving.

And quadratic funding may reduce those things that we worry about:

- It’s innovative but without a lot of unnecessary risk;

- it involves major donor giving, but also involves crowd-funding and smaller donation-givers in a meaningful way;

- and it creates an opportunity for buzz and excitement that may create new communities for our nonprofits.

I’d just get someone else to do the math.

Further reading

Great explanation here of quadratic funding and the new Endaoment Universal Fund for charitable giving: Crypto Altruism, “Crypto Philanthropy meets Quadratic Funding in new Endaoment-Gitcoin Partnership” https://www.cryptoaltruism.org/blog/crypto-philanthropy-meets-quadratic-funding-in-new-endaoment-gitcoin-partnership

The nuts and bolts: How QF works: https://www.wtfisqf.com/

Quadratic funding: The future of crowdfunding, explained, by Jagjit Singh. May 6, 2023. https://cointelegraph.com/explained/quadratic-funding-the-future-of-crowdfunding-explained