This week I watched another fascinating/informative/alarming/stellar PBS Frontline documentary called The Power of the Fed, which I highly recommend if you want to get a well-explained idea of what is happening with US financial markets right now.

This week I watched another fascinating/informative/alarming/stellar PBS Frontline documentary called The Power of the Fed, which I highly recommend if you want to get a well-explained idea of what is happening with US financial markets right now.

One of the phrases that came up repeatedly during the program was shadow banking. It’s one of those terms I delved into pretty intensively during and after the 2008 financial crisis, but it’s one I haven’t heard come up again until recently.

I thought it was time to explain what shadow banking is here on The Intelligent Edge because it’s becoming relevant again and is more in the news. Which maybe isn’t such a good thing, you know?

What are shadow banks?

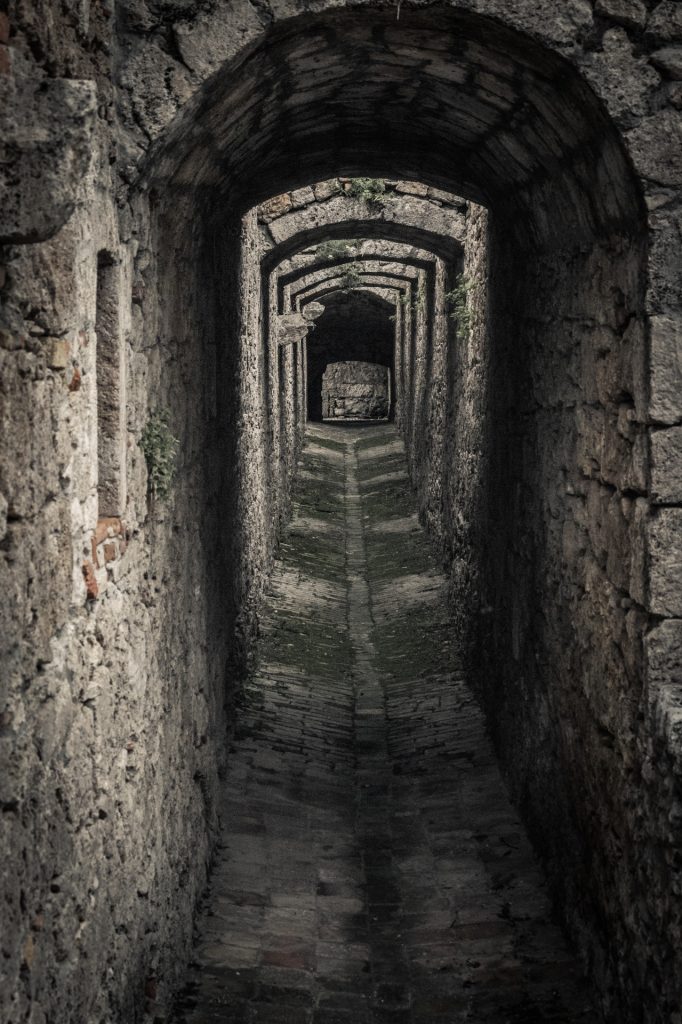

They’re called shadow banks because, in the flow of money globally, there are some financial institutions that operate outside of (or under the radar of) traditional banking regulation because they do things that traditional commercial banks don’t do.

On a very simple level, commercial banks (like Bank of America, or Fleet Bank, or Watertown Savings Bank) exist to store money from the public, invest it, and lend it back to the public. You can go into any commercial bank and deposit money in a savings or checking account. They will take that money and lend it to others and give you back some of the interest from those loans. Or they’ll take your money and hold it for you until you spend it using your debit or credit card.

How banks do what they do is intensely regulated by federal and international laws and agreements. There are things that commercial banks are not allowed to invest in, like junk bonds for example, because they’re too risky. Also, they’re required to hold a certain amount of money in reserve and to guarantee your deposits up to a certain amount. If you give them $25,000 to hold in an account for you, they are required to have insurance that guarantees that you’ll get it back.

Shadow banking is pervasive in the world and most of the activity centers on the creation and re-selling of collateralized loans and repurchasing agreements used in short-term lending between (non-bank) institutions and broker-dealers. There are no reserves backing the investments, and there’s no insurance to cover any losses. Which is why, when deals go well, investors can make a l-o-t of money because they take on a lot of risk.

Because of their description, it sounds like the participants are hiding in some shadowy back alleys, but you’ve probably heard of (and maybe even used the services of) some of them. Some of them even have banks as subsidiaries (yes, that’s as weird as it sounds). Here’s a list of examples of shadow banks:

- investment banks, like Goldman Sachs or Morgan Stanley

- mortgage lenders (ever taken out a Quicken Loan? In 2018 they surpassed Wells Fargo as the largest mortgage holder in the US.)

- money market funds (here’s an example of a hybrid: Schwab is a broker-investor for money market funds that also has an affiliated bank)

- insurance/re-insurance companies

- hedge funds

- private equity funds

- payday lenders

- peer-to-peer lenders, like LendingClub

Shadow banks move money around in the background. They bundle and invest in things in aggregate, like thousands of mortgages, and sell them on to others. They invest in start up companies (which banks can’t/won’t do). They invest in repossessed assets, and flip them for profit. They buy, re-bundle, and sell commercial bonds (including junk bonds). Amongst many other ways, they make money from their management fees and from betting that interest rates will go up (or down) on the assets they’re buying or selling. And by making risky deals that work out.

These money-movers use short-term, quickly-raised money to fund longer-term assets, so if the market goes bust in the long-term asset area, the shadow bank needs a bailout from somewhere or it goes bust, too, since there is little regulation and no reserve funds to guarantee the investments.

Anticipating that happening (and preventing it) is one of the jobs of the Federal Reserve, and their skill in watching the mile markers whip by on this current economy’s journey (and deciding where the economy should exit or put on the brakes) is where the Frontline program was particularly fascinating. I love hearing insights from people who either are on the inside, or recently were, and Frontline’s interviews pulling out what we should see next from regulators (and what might happen instead) was a real education.

How big is the shadow banking sector?

According to the Financial Stability Board’s (FSB’s) most recent Global Monitoring Report on Non-Bank Financial Intermediation released in December 2020, the shadow banking sector accounted for almost half (49.5%) of the global financial system in 2019. Almost half of money moving around right now is unregulated. What could possibly go wrong?

The US is the global leader in shadow banking asset holdings with China not far behind; this sector makes up nearly one third (29%) of China’s total banking assets, according to a recent article in The Banker. China’s banking regulators are currently working to keep the sector in check by banning banks and wealth managers from holding sub-investment grade assets, and time will tell how effective the legislation is. The shadow banking sectors in Brazil, Canada, and India are also growing apace. Our economies are all interconnected, so it’s important for us to understand this as we research ultra high net worth prospects involved in these sectors, and estimate their future potential giving.

And not only that, of course. It’s important to understand because we may not even realize how deeply shadow banking impacts our own daily lives and personal assets. If you have 54 minutes, I recommend spending it on the Frontline documentary this week.