Back in the 80s (and then again briefly in the 90s) there was a tv show hosted by a guy named Robin Leach called “Lifestyles of the Rich and Famous.” Leach took you into celebrity homes, yachts, and resort destinations to provide a glimpse into how The Other Half lived. It was a prospect researcher’s dream show. [Read more…]

Freeports: The Purgatory for Art

As the HBG Book Club group read about tax-free zones called freeports last week in Jake Bernstein’s page-turner, Secrecy World, it was a perfectly-timed coincidence that this fascinating Planet Money podcast came out on that very topic. [Read more…]

Super brokers in our fair city

Last week one of our favorite fundraisers got in touch after reading Kelly Labrecque’s blog article about real estate super brokers in New York City.

Hey, what about us in New England? she asked. I work for a Boston-based nonprofit, and a lot of our donors are in the construction business.This would be a great allied group for us to tap into!

Great point. There are super brokers all over the world, and equally super resources to find out more information about them. [Read more…]

Super Brokers in the City

In considering those with high net wealth, we often think about the owners of luxury real estate, but not the people who make their (potentially sizeable) living helping them buy it. So this week, we’re delighted to welcome back HBG Senior Researcher Kelly Labrecque to share her deep knowledge and clear enthusiasm about researching real estate “Super Brokers.” ~Helen

In considering those with high net wealth, we often think about the owners of luxury real estate, but not the people who make their (potentially sizeable) living helping them buy it. So this week, we’re delighted to welcome back HBG Senior Researcher Kelly Labrecque to share her deep knowledge and clear enthusiasm about researching real estate “Super Brokers.” ~Helen

In the world of luxury residential real estate, there is an elite group of men and women who represent some of the most exclusive listings and clientele. These top brokers, also known as “super brokers,” close deals worth hundreds of millions of dollars each year.

You can find super brokers all over the world, but with shows like Bravo’s “Million Dollar Listing” and HGTV’s “Selling New York,” we have become most familiar with those in markets like Beverly Hills, Palm Beach, and New York City.

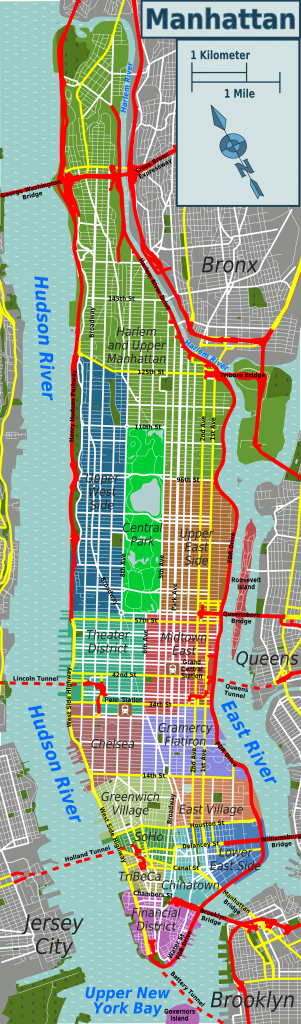

Since I have a particular fascination with real estate in Manhattan, I thought I’d share a few interesting facts about that market and its super brokers.

(Of course) Manhattan is expensive!

The average cost of an apartment in Manhattan is now just over $2 million.

Despite declining sales and increased marketing time, Douglas Elliman, the nation’s fourth largest real estate company, reported that the Manhattan residential real estate market experienced both higher prices and increased inventory in the third quarter of 2016 (July through September). In addition, there has been a surge in new development over the last year resulting in some astronomical sales prices.

For example, in September, the New York Times featured the sale of a full-floor penthouse at 432 Park Avenue for an astounding $87.66 million! Eight additional units in the building sold that same month, ranging in price from $18.98 million to $43.3 million.

And let’s not forget the record-breaking sales that closed in 2015 at One57 consisting of a duplex penthouse purchased by an anonymous buyer for $100.4 million and the “Winter Garden” duplex purchased by billionaire Bill Ackman and his associates for $91.5 million.

So what does that mean for super brokers? [Read more…]

Interviewing Venture Capital and Private Equity Professionals

Sometimes secondary research just doesn’t cut it. As fundraising professionals, we all know it’s important for us to understand the context of our prospects’ lives. But as much as you can read about private equity, venture capital, and all the other finance-related professions, nothing beats actually talking with people in that industry to find out how they would like to be cultivated and stewarded. I’m particularly delighted this week to shine a light on a project that University of Chicago researchers, Amelia Aldred and Namrata Padhi, undertook to interview professionals in the finance industry. In this week’s article, Amelia and Namrata share the questions and answers about these professionals that we all want to hear. ~Helen

The problem and our solution

In 2015, our prospect research team hit a wall when it came to understanding venture capital and private equity professionals. Like many of our research colleagues, our team read hundreds of articles about venture capital and private equity industries but we couldn’t find information specifically about venture capital and private equity professionals’ attitudes and behaviors regarding philanthropy, nor could we find information about compensation and wealth beyond a general industry overview.

Our solution? Change our research methods. Instead of reading, we directly interviewed venture capital and private equity professionals about their career path, compensation and wealth accumulation, networks, and how all of these factors affected their approach to giving. [Read more…]

Stumbling Toward Success

Great pieces of information can come our way from any number of sources, often when we’re least expecting it. In this week’s article, HBG Senior Researcher Tara McMullen shares some great advice on how to spot clues that can lead you down a path of discovery.

The inventor Charles Kettering, who held more than 180 patents and was responsible for major revolutionary advances in the automotive industry, was clearly no stranger to the field of research and its challenges. As a fundraising researcher, I often take his words to heart. In our field, we sometimes spend hours scouring resources, seeking to find as much information as we can on a prospective donor –those useful bits and bytes that we need to obtain useful insight. What has their career looked like? Who are the members of their family? Where do they live? And, ultimately, do they have a passion for philanthropy, and the financial resources to generously support this passion? [Read more…]

The Best Parts of the 2016 Sunday Times Rich List

You know that the Sunday Times Rich List came out this past weekend, right?

The list is a tremendous feat completed annually by Philip Beresford and Robert Watts (who will take over for Beresford later this year). For me it’s like someone showed up at my door handing me keys to a snappy convertible, a box of Lake Champlain chocolates, and a leash with a wee sleepy puppy at the end of it.

Yes, I’m self-aware about my tendency toward hyperbole, but seriously, I’m pretty sure I heard angels weeping on Sunday.

Wonderfully, the ST list of the top 1,000 wealthiest isn’t just one list, it’s actually 28 glorious lists. There’s some overlap, of course, but Beresford and Watts don’t just rehash and reorder the 1,000 – there are many more names to be found in the separate, searchable, lists. [Read more…]

How Dodd-Frank Affects Your Top Donors

This week we welcome back HBG Senior Researcher Kenny Tavares to the blog. Earlier this year, Kenny and fellow HBG senior researcher Elizabeth Roma shared their extensive research on family offices in a podcast. In this week’s article, Kenny shares more about the legislation affecting hedge funds and family offices, and how this could impact the philanthropic landscape.

With Halloween approaching, the time is right for a scary topic! Pull up a chair and let me tell you about the Dodd–Frank Wall Street Reform and Consumer Protection Act, aka Dodd-Frankenstein. Wait, no, sorry. I meant Dodd-Frank. [Read more…]

Donor Identification in the 21st Century

As you probably remember from my previous article on this topic, it’s a myth that high net worth people don’t use social media. Studies show that the adoption rate in that demographic is growing every day, too.

As you probably remember from my previous article on this topic, it’s a myth that high net worth people don’t use social media. Studies show that the adoption rate in that demographic is growing every day, too.

That’s great for those of us in fundraising, because new sources like these help us to (as Chris Carnie recently discussed in a terrific podcast with Ben Rymer) craft a donor-centered relationship for each individual donor – because we can (and should) treat them as individuals. [Read more…]