Today, October 10, 2024, is the first ever DAF Day.

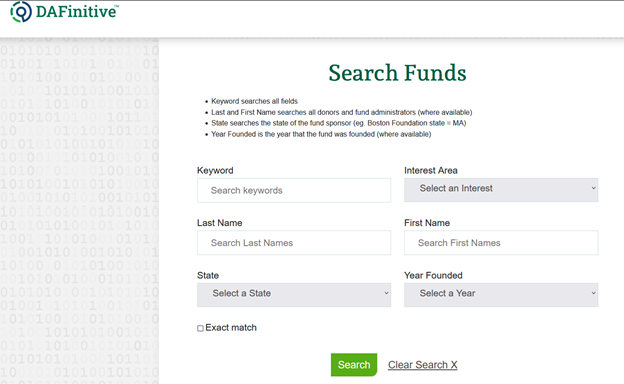

Here at HBG, we host an entirely separate blog dedicated to donor advised funds. You can check out our DAFinitively Speaking blog here or follow DAFinitive on LinkedIn. But, given that today is DAF Day, there’s no reason not to cross-pollinate, just a little bit!

What is a DAF, you might ask?

DAF stands for Donor Advised Fund.

At its simplest, a DAF is an investment account that a donor can use to designate money for charitable purposes.

The vast majority of DAF donors are people, however a number of companies leverage DAFs as part of their corporate giving programs as well.

For non-profits, think of a DAF as a type of giving vehicle. Just as a donor could send you a check via the mail, make an online contribution, or gift shares of stock, a donor could also direct funds from their DAF to your organization.

How does a DAF work?

Every DAF in the United States is managed by a sponsoring organization, which is a registered 501(c)3 non-profit.

The majority of sponsors are community foundations, like the Boston Foundation or Silicon Valley Community Foundation.

Sponsors can also be affiliated with a large financial institution, like Fidelity or Schwab, but it will always be under a separate non-profit umbrella.

Lastly, some single-issue non-profit organizations also serve as DAF sponsors. You will see this with organizations like Jewish Community Foundations, Catholic Charities, some advocacy organizations, or even large universities.

When a donor makes a gift to a DAF, they are really making a gift to the sponsoring organization and designating their gift to be held in the DAF. At that point in time, the funds become the fiduciary responsibility of the sponsoring organization, not the donor. And, the donor is eligible to receive a tax deduction because, after all, they have made a bona fide gift to a non-profit organization.

While the money sits in a DAF, most sponsors offer investment options so that the money can grow over time, just like in a savings account or mutual fund.

The only way that funds in a DAF can be used or spent is for charitable purposes. So, at their leisure, the donor can direct (or advise!) the sponsor to make a distribution from their DAF to any non-profit of their choosing.

So, what is DAF Day?

Ultimately, DAF Day is a marketing effort to activate DAF advisors to make distributions from their DAFs to non-profit organizations, today. As of the writing of this post, over 1,000 non-profit organizations, 5 sponsor organizations and 20 technology partners have joined the movement.

Marketing efforts like this are not a new concept in philanthropy. Combining a sense of community, rallying around a cause and creating a sense of urgency is a proven strategy – usually under the more generic title of a Giving Day.

As an example, Giving Tuesday was launched in 2012 to mobilize philanthropic activity on the Tuesday after Thanksgiving. In 2022 alone, Giving Tuesday sparked $3.1 billion in giving.

According to the Annual Giving Network, “nearly 90% of colleges and universities report that giving days are increasingly important part of their annual giving program.” While most higher education institutions tend to hold their Giving Days in the spring, dates vary, frequently to be significant to a particular institution’s events or traditions.

And, even before the phrase “Giving Day” existed, the first known ‘day of giving’ was likely the first Muscular Dystrophy Association (MDA) Telethon, which dates to the 1950s! Hosted for decades by Jerry Lewis, it became known to many as the “Jerry Lewis Telethon,” and aired live on TV.

Why launch DAF Day now?

The popularity of donor advised funds has exploded in recent years.

There are roughly 10x as many DAFs today than there were a mere decade ago.

According to Giving USA, giving from DAFs accounts for nearly a quarter of all philanthropic donations.

And, one of the first-ever benchmarking studies on DAF donor behavior showed that both retention and lifetime value of donors who give through their DAFs are better than the typical one-time donor.

Yet, DAFs often get a bad rap as a place where people park money without distributing it to non-profits.

While this might be true in the minority of cases, DAF account holders are generally philanthropic individuals and the velocity of money moving in/out of DAFs is far greater than what we typically see at private foundations.

However, there’s always more than can be done to spark someone’s passion to support the charitable community. And, research suggests that as of last year, there was more than $234 billion sitting in DAFs, earmarked for philanthropy, and waiting to be distributed.

So, why not now?

However, the proof is always in the pudding, so to speak. Just as I do each year with so many other reports, I’ll be most interested to see the analysis after DAF Day has concluded. If successful, I suspect that DAF Day will become an annual tradition, just like the other Giving Days that proceeded it.

To learn more about DAFs, check out:

- Our blog, DAFinitively Speaking

- DAFinitive®’s free resources page

- The DAF Day website

- The 2024 National Study on Donor Advised Funds, from the DAF Research Collaborative

- 2023 NPT Donor-Advised Fund Report

- Influence, Affluence & Opportunity: Donor-advised Funds in Canada (KCI/CAGP)

Image Credit: “Dollar Heart” by cmpalmer is licensed under CC BY-SA 2.0.