In considering those with high net wealth, we often think about the owners of luxury real estate, but not the people who make their (potentially sizeable) living helping them buy it. So this week, we’re delighted to welcome back HBG Senior Researcher Kelly Labrecque to share her deep knowledge and clear enthusiasm about researching real estate “Super Brokers.” ~Helen

In considering those with high net wealth, we often think about the owners of luxury real estate, but not the people who make their (potentially sizeable) living helping them buy it. So this week, we’re delighted to welcome back HBG Senior Researcher Kelly Labrecque to share her deep knowledge and clear enthusiasm about researching real estate “Super Brokers.” ~Helen

In the world of luxury residential real estate, there is an elite group of men and women who represent some of the most exclusive listings and clientele. These top brokers, also known as “super brokers,” close deals worth hundreds of millions of dollars each year.

You can find super brokers all over the world, but with shows like Bravo’s “Million Dollar Listing” and HGTV’s “Selling New York,” we have become most familiar with those in markets like Beverly Hills, Palm Beach, and New York City.

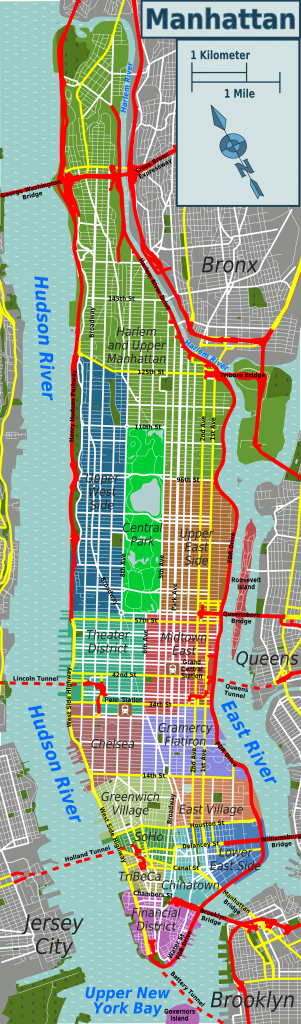

Since I have a particular fascination with real estate in Manhattan, I thought I’d share a few interesting facts about that market and its super brokers.

(Of course) Manhattan is expensive!

The average cost of an apartment in Manhattan is now just over $2 million.

Despite declining sales and increased marketing time, Douglas Elliman, the nation’s fourth largest real estate company, reported that the Manhattan residential real estate market experienced both higher prices and increased inventory in the third quarter of 2016 (July through September). In addition, there has been a surge in new development over the last year resulting in some astronomical sales prices.

For example, in September, the New York Times featured the sale of a full-floor penthouse at 432 Park Avenue for an astounding $87.66 million! Eight additional units in the building sold that same month, ranging in price from $18.98 million to $43.3 million.

And let’s not forget the record-breaking sales that closed in 2015 at One57 consisting of a duplex penthouse purchased by an anonymous buyer for $100.4 million and the “Winter Garden” duplex purchased by billionaire Bill Ackman and his associates for $91.5 million.

So what does that mean for super brokers?

Let’s look at the numbers

Although sales volume and listing price varies from broker to broker, super brokers typically focus on listings with sales prices exceeding $5 million.

As you can imagine, a broker’s portfolio will likely contain a higher volume of listings in the lower end of the range ($5 million-$10 million) with far fewer $96 million duplex co-ops and $85 million 10,000-square-foot 8BR/8BA condos.

Based on information derived from the Real Deal’s 2016 list of New York City’s top residential brokers, those ranked in the top twenty each sold an average of 24.85 listings (median: 20) with an average total value of $332.35 million (median: $297.5 million) or $13.37 million per listing.

With these statistics, we can estimate the average compensation of a super broker in the current market.

Commission, splits, and annual compensation.

In a transaction with a standard commission rate of 6%, the proceeds are split equally between the buyer’s and seller’s brokers. Therefore, on a $13 million sale, each broker would receive $390,000 at closing. However, depending on the broker’s employment contract and seniority, his or her brokerage firm could take as much as 20% to 50% of those proceeds. Still, not a bad pay day at $195,000-$312,000 per sale. Multiply that by 24 sales per year and your super broker is a multi-millionaire (even after taxes!).

Remember, these super brokers represent the top echelon of their field and their income is market-dependent. Just because a broker closed on $300 million in listings last year does not mean he or she will perform at that level every year. Be sure to follow market trends via the quarterly research reports released by the Real Estate Board of New York (REBNY), Douglas Elliman, and the Corcoran Group.

Also, super brokers often make upfront investments of their own capital in order to stage and market a listing or to win an ultra-high net worth client. This will take away from their final profit.

Even super brokers need a team

For the last two years, the top New York City brokerage firms have consistently been Douglas Elliman, the Corcoran Group, and Brown Harris Stevens (based on number of listings and sales volume).

The majority of super brokers ally themselves with one of these well-respected, high volume firms. Some even lead eponymous teams within these brokerages such as the Richard J. Steinberg Team and the Eklund Gomes Team at Douglas Elliman, the Carrie Chiang/Janet Wang Team at the Corcoran Group, and the John Burger Team at Brown Harris Stevens. These teams, made up of a lead broker and 5 to 10 agents, enable the super broker to take on a higher volume of listings, as well as, more “big-ticket” listings.

Other super brokers like Dolly Lenz, former vice chairman of Douglas Elliman, go on to establish their own firms.

Making the case for super brokers as prospects

Aside from the fact that super brokers are typically wealthy in their own right, they are some of the most well-connected folks in Manhattan. On a daily basis, these brokers work with the very people we, as researchers and fundraisers, try to cultivate and steward. Super brokers are also active in the community and serve on the boards of a number of non-profit, community service, and civic organizations.

For example, Elliman super-broker Raphael De Niro, who sources say may have made as much as $5 million in 2012, serves on the board of the Tribeca Film Institute, which was co-founded by his father, actor Robert De Niro. Raphael’s wife, Claudine, serves on the leadership council of Beyond Type 1, a non-profit dedicated to diabetes research and patient support.

Dolly Lenz, who owns homes in Southampton and Manhattan, serves on the boards of NYC Police Athletic League and The Chopra Foundation. And Elliman’s Richard J. Steinberg, whose sales totaled just under $460 million in 2015, is a trustee of Guild Hall in East Hampton.

So don’t let these critical prospects pass you by!

Staying alert

Keeping up with super brokers is made easier by setting up news alerts for specific broker names or luxury building addresses in LexisNexis, Google, or Mention.

You can also follow them via their specific brokerage firms and team webpages. Here, you can get an idea of his or her average sales volume and listing price.

It’s also a good idea to stay informed by regularly reading industry publications like the New York Observer and New York Times real estate sections, The Real Deal, and Haute Residences New York. These resources can keep you up-to-date on the latest market trends, major sales, and development projects.

Let’s hear from you!

Have you ever researched a super broker? If so, how did you determine capacity? What resources did you find helpful?