This week we have a real treat of an article: HBG’s Associate Director for Consulting, Tara McMullen-King, interviewed Amy Begg, former NEDRA board president and an Ann Castle Award recipient. Amy is also an active cryptocurrency miner (with a heart of gold!). Tara and Amy had a fascinating discussion about crypto mining, and Amy generously shared her knowledge and experience about what it means to mine cryptocurrencies. Huge thanks to Amy for taking the time to explain it all for us! ~Helen

It is clear that the demand for cryptocurrency and crypto mining is not subsiding any time soon – as of August 2021, the combined value of the world’s cryptocurrencies stood at about $2 trillion. Not only are more people investing in crypto, but an increasing number of donors are using cryptocurrencies like Bitcoin to fund their charitable contributions. According to a recent article in the New York Times, there has been a significant increase in cryptocurrency donations to donor-advised funds – for example, Fidelity Charitable received $150 million in cryptocurrency in 2021, up from $28 million in 2020 and only $13 million in 2019. And in May 2021, it was reported that a $5 million anonymous gift in the form of Bitcoin had been made to the Wharton School at the University of Pennsylvania – the largest cryptocurrency gift ever made to the University.

While many nonprofits are still not set up to accept gifts of cryptocurrency, more and more are beginning to put the internal infrastructure in place to do so, or signing up to accept crypto gifts through donation platforms like The Giving Block – in part because of some of the benefits. Donors can benefit from tax write-offs since cryptocurrency is classified as property (which means no capital gains tax and a fair market value deduction). They are also cost-efficient for organizations involved in international transactions since they eliminate the usual costly associated international banking fees. And with close to half of Millennial and Gen-Z investors owning cryptocurrencies, making the choice to accept crypto donations will also potentially provide an opportunity for nonprofits to engage with a new generation of younger donors in the future.

But how does cryptomining work? How do people get started in the field? And what even IS cryptocurrency? To try to get some answers to these questions, I sat down for a conversation with Amy Begg, Managing Director of Prospect Management at Harvard University, who is a miner with a wealth of knowledge and insight about all things crypto!

Tara McMullen-King: How do you see cryptocurrency impacting our work in nonprofit fundraising? Do you see a need for more nonprofits to set themselves up to accept Bitcoin and other digital assets?

Amy Begg: There is just a LOT of wealth creation going on right now, at different levels. More and more people are becoming interested in cryptocurrency and are finding ways to mine and invest in things like Bitcoin and Ethereum – and I don’t see this stopping any time soon! You are also seeing more family offices offering Bitcoin to clients. I definitely think there is a need for more nonprofits to get into the crypto space, because I think crypto is the future of money. For example, you take something like the Bitcoin Beach project where an anonymous Bitcoin HODLer made a donation to help create this entire Bitcoin economy in this little village on the coast of El Salvador…. and it has completely changed the village and people’s lives there. Most of the population didn’t have easy access to banks, and most of the local businesses couldn’t accept credit cards since they didn’t qualify for merchant accounts. Now they can pay for things – and get paid themselves – in Bitcoin in this tiny little village. They have also seen that it is teaching them about finance and how to save money, since they don’t want to spend their Bitcoin (as they are able to watch it increase in value). And now El Salvador just passed a bill in June making it the first country in the world to adopt Bitcoin as legal tender!

Tara: What does it mean to “mine” cryptocurrency? What types of cryptocurrencies can someone mine?

Amy: The term “cryptocurrency mining” or “cryptomining” means gaining cryptocurrencies by solving cryptographic equations using computers. This process involves validating data blocks and adding transaction records to a public record (a ledger) known as a “blockchain.” (Here is a good video from the New York Times: https://youtu.be/0B3sccDYwuI)

Some of the most popular coins to mine are:

- Bitcoin

- Ethereum

- RavenCoin

- Monero

- LiteCoin

- Ethereum Classic

- Zcash

- Grin

- Metaverse

- Bitcoin Gold

- Dogecoin

- DASH

- Vertcoin

- DigiByte

- Monacoin

- Aeternity

- Cardano

- VeChain

- BitTorrent Token

Most of today’s coins are mined by GPUs and ASIC miners. GPUs are video card-based mining, which is typically used for gaming – these miners are flexible and have the potential to mine different cryptocurrencies, enabling you to switch between coins (in case the market is bearish or bullish). However, GPU mining consumes lots of power and involves complex computation. ASIC miners work on particular algorithms and have the sole purpose of mining cryptocurrency – these can run much faster than GPUs and can lead to greater profits!

There are a lot of different coins that can be mined –if someone is considering getting into mining, they should investigate the profitability of a coin. There are many sites that can help with this – my personal favorite is WhatToMine. Some of the factors you want to take into consideration include your electricity costs, the type of equipment you plan to use (ASIC miners versus GPUs), and the calculated hash rate.

Once you enter the total hashing power of your mining rigs, you can check each GPU, CPU, or ASIC chip’s rate. The next step is to enter the total power consumed by your rigs in watts, and then the price of your electricity in kWh (kilowatt-hours) – if you are not aware of the prices per kw, you can ask your electricity provider. If you have joined the paid mining pool, you then enter its fee. After deducting all these expenses, the mining calculator will calculate the net profit you would expect to make per day, month, or year.

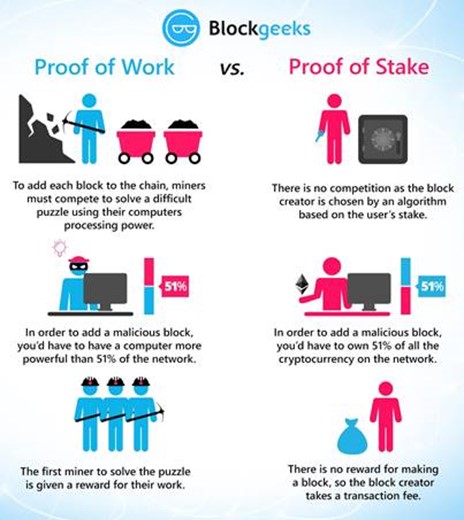

There are two ways to generate coins: Proof of Work (PoW) and Proof of Stake (PoS). Any coin that is generated by Proof of Work is minable; Proof of Stake can be done by staking your coins. Most recently, Ethereum has been the most profitable coin to mine – the Ethereum community and its creator, Vitalik Buterin, are in the process of attempting to move from PoW to PoS.

From https://www.bitdegree.org/crypto/tutorials/proof-of-work-vs-proof-of-stake:

Tara: Can someone mine crypto on their personal computer, or do they have to build a separate set-up? What does it take to build a mining setup– is it difficult or expensive? What does your daily mining process look like?

Amy: Each coin has a specific algorithm associated with it – and in order to mine that coin, you need to have a processor that can handle not only the algorithm, but the size of the blockchain associated with that algorithm (which grows over time). A data structure called a DAG (Directed Acyclic Graph) is used – it is like a database that connects different pieces of information together. In cryptomining, a DAG records transactions and makes mining secure – without a DAG, a mining algorithm has no way to track, notate, or reward you for your mining. But any processor used for mining must have the capacity to support the size of the DAG file – which can be large (Ethereum, for example, is over 4.3GB). Most CPUs don’t have the capacity to support this – GPUs, on the other hand, contain enough memory to support the size of the DAG file.

I primarily mine Ethereum, and my set-up (see below) includes both ASIC miners and rigs with GPUs from NVIDIA which I purchased on eBay. On a day-to-day basis, there is not much to do! My machines run 24/7, and I can access them via remote desktop.

It does cost quite a bit to get started in mining crypto – and it requires a good deal of electricity. Currently, there is also a shortage of GPUs – so they are hard to come by! For anyone who is interested in purchasing equipment for mining, I would recommend that they do a lot of research. It is also worth noting that it can take up to a year to recover the set-up costs.

Tara: What advice do you have for folks who might want to get started in cryptomining? Are there good resources out there for people to learn more?

Amy: Bits Be Trippin’, Red Panda Mining, and Son of a Tech all have YouTube channels that I highly recommend watching – they break down the profitability of coins and the different types of GPUs that are out there.

Another factor that someone needs to consider is which mining pools to join – I have used Nice Hash, Nanopool, and Ethermine. You can always solo mine, but the difficulty for mining a block requires a much higher combined hash rate for all of your GPUs and ASIC miners in order to be successful in solving the block.

One main piece of advice I would give is to spend some time learning about the different cryptocurrencies that are out there. Also worth noting is that to mine, you will need a cryptocurrency wallet to mine to – there are a lot of options out there, and not all of them have the same coins. I personally use quite a few wallets for my crypto, such as Binance.US, Gemini, Coinbase Wallet, and Atomic Wallet. Coinbase is particularly great for beginners because it offers videos for people to watch about specific tokens – and then rewards you in cryptocurrency for watching them!