Finding information about public companies is so easy! Unfortunately, the majority of companies in the world are privately-held, so finding information about them – especially how much a company is worth – is a daunting task. Thankfully, today my colleague Grace Chandonnet provides a huge hand up for those of us who aren’t professional company valuers with this enormously helpful article. ~Helen

It’s an age-old prospect intelligence challenge. Especially if you’re new to our field, placing a value on a privately held company, and on your prospect’s stake in that company, can seem daunting. Publicly traded companies are required to report their financial information to the SEC, and that information (things like market capitalization, revenue, number of employees, and insiders’ stock holdings), is then available to the public. Privately held companies are not under the same legal obligations, so getting at their financial information is a bit trickier and less straightforward. The good news is that there are some pretty simple tricks that can help a researcher arrive at a reasonable guess as to the value of a private company.

You will need a couple of pieces of information, and the fact is that sometimes you will not be able to know enough information to make a realistic estimate. But there are some resources to help.

If you can uncover a reliable estimate of the company’s revenues, that’s a great start. The unicorn is to find a news article, often published in business or industry publications, that is talking about the company’s industry and uses your prospect’s company as an example. In this article, the exact amount of revenue is not reported, but enough information is provided about the company, a provider of solar energy, to figure it out. The company “reported a 124% gain over 2018 gross sales – an increase of $42.4 million” – when you do the math, you will arrive at 2019 gross revenue of about $76.6 million.

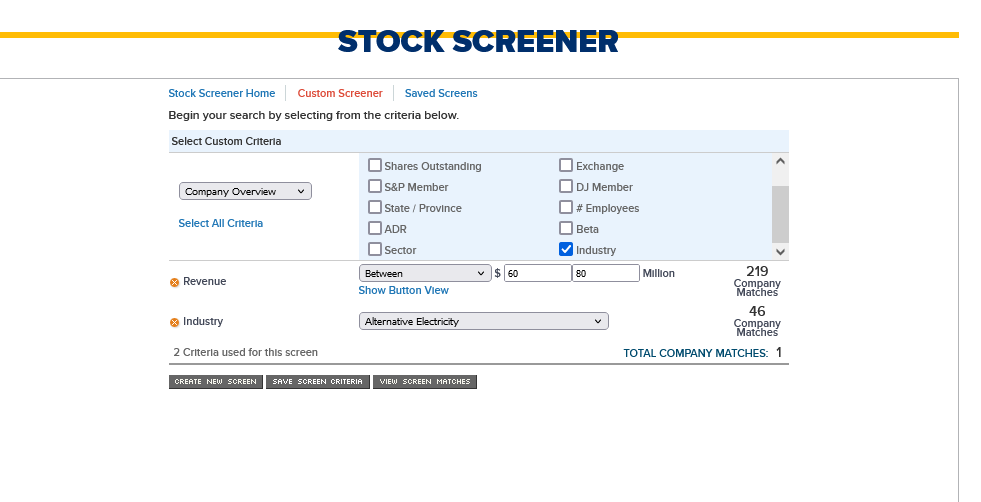

If I have information like this, the first thing I will do is try to find one or more publicly traded companies with a similar line of business and similar revenue, and then compare the public company or companies to the privately held one that I am researching. To find similar public companies, I use a stock screener like this one, which is a free resource.

Select Create Custom Screen and then pull down on Select Category to Current Financials and select Revenue. Enter the revenue criteria (I use a range of values, in this case between $60M and $80M). Once you’ve entered that and clicked in the box to activate the search, go back to the pull-down menu. Pull down to Company Overview and then click on Industry (scroll down in the box, it’s slightly hidden). For this example, I picked “Alternative Electricity”. As you’ll see in the image, there is only one search result, but it’s a good one – click on View Screen Matches to see results. The piece of information to look for in those results is the market capitalization or market cap, which is the total value of the publicly traded company because it is reasonable to assume that there is some similarity between the market capitalization of the public company ($373.1 million) and the value of the private one.

Select Create Custom Screen and then pull down on Select Category to Current Financials and select Revenue. Enter the revenue criteria (I use a range of values, in this case between $60M and $80M). Once you’ve entered that and clicked in the box to activate the search, go back to the pull-down menu. Pull down to Company Overview and then click on Industry (scroll down in the box, it’s slightly hidden). For this example, I picked “Alternative Electricity”. As you’ll see in the image, there is only one search result, but it’s a good one – click on View Screen Matches to see results. The piece of information to look for in those results is the market capitalization or market cap, which is the total value of the publicly traded company because it is reasonable to assume that there is some similarity between the market capitalization of the public company ($373.1 million) and the value of the private one.

If I have multiple companies in my search results, I will use the average market cap for the companies in the list that are the most similar to my prospect’s company. When doing this, I leave out any outliers – where the market cap is a lot lower or higher than most of the companies in the list.

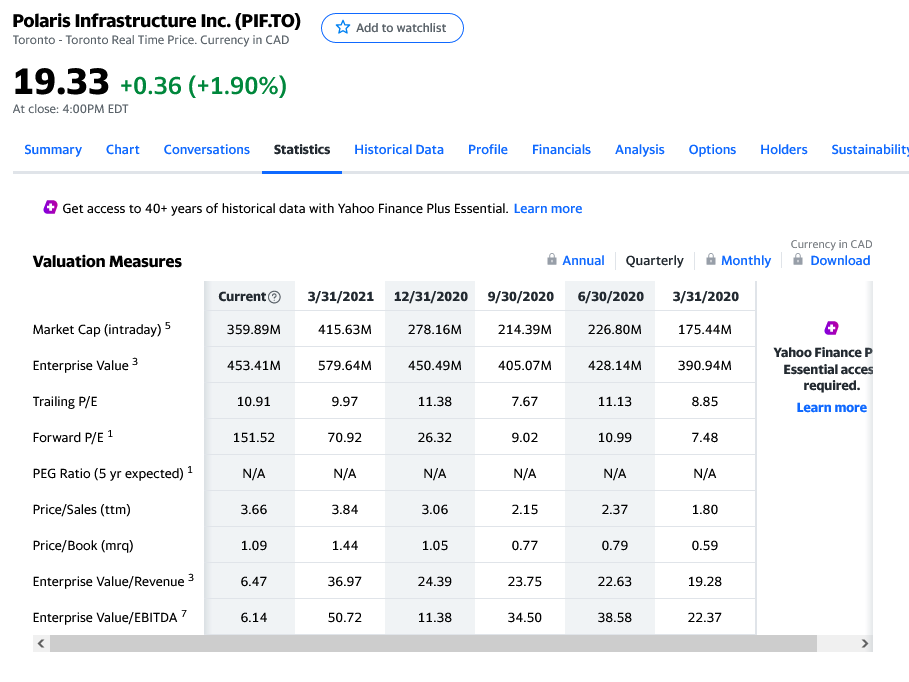

If, however, you know that your prospect is trying to sell her company or that she already has, the value you want to look for is the enterprise value rather than the market cap. Enterprise value is the amount that a company could fetch in an acquisition. You can find this number by looking up the comparison public company or companies at any number of free sources. I like Yahoo Finance, where you can find the enterprise value under the Statistics tab.

Of course, a good deal of the time, you won’t find an article that tells you exactly what your prospect’s company’s revenues are or there just won’t be good comparison public companies in your search – sometimes a close industry match isn’t available or (if you do have an estimate of revenue), there won’t be any companies with revenues in that range.

My second go-to in cases like this is the Business Reference Guide, which is a paid resource, but not terribly expensive. This resource is available as an online subscription, a book, or both. It is focused on pricing businesses and franchises and is geared toward entities that are seeking to buy a company or franchise. It is chock full of industry benchmarks and trends, rules of thumb when assessing certain industries or franchises, and ways to assess a ballpark figure for what a company is worth using a host of different data points that you may have. If you have an estimate of the number of employees a company has, for instance, you can often find a simple multiplier to use to estimate a company’s valuation.

This of course brings us back to whether you have that information and where to find it. I like to look at my prospect’s company in several different resources, including Dun & Bradstreet and ZoomInfo, both of which are included in a Lexis Nexis for Development Professionals (LNDP) subscription, and see how these resources’ results compare to one another. If you have access to LNDP, you not only have access to both of these resources, but also to a host of others, including Gale Group Company Briefs, IAC Company Intelligence, and Lexis Nexis Corporate Affiliations.

iWave is another great source of aggregated company information. Dun & Bradstreet has often been maligned in our profession for not containing trustworthy information because its data is frequently based on self-reported numbers and/or modeling, so it should be taken with a grain of salt. I’ve been finding lately that ZoomInfo often returns data about revenues and number of employees that seem pretty accurate to me. With practice, you will be able to identify which information is probably wildly inaccurate versus information that seems quite reasonable. D&B Private Company Insight (also available in LNDP) often has information about what percentage of the company is owned by whom, and this is great to know. Estimating the value of a company is one thing, but knowing how much of the company your prospect owns is the next (and important) step to including these numbers in your capacity score.

The more you do this kind of research, the more you will trust your instincts about what seems to be relatively accurate numbers, both for revenue and number of employees. There will always be things we can’t know abut a privately held company, such as the value of inventory or machinery and other hard assets, and debt/liabilities, but I believe that we should at least attempt to understand what a privately held company could be worth when assessing a capacity rating for a business owner, and I also believe that these relatively simple calculations can result in a strong estimate.

Some additional things to consider:

- What percentage of the company does your prospect own? If you don’t know, estimate conservatively – I like to use 10 to 25 percent ownership.

- Is it a multi-generation family business? This could indicate that there are minority shareholders (family members) and should be taken into account when assessing your prospect’s true stake.

- Did your prospect found, grow and continues to head the company? This could indicate 100 percent ownership for your prospect.

- Is it venture funded? Investors will own some stake in the company if so. Sometime the percentage of company owned by the investors can be found in a news search, but not always. If not, be conservative when estimating what your prospect’s ownership percentage is.

- A company’s valuation is not a liquid asset for your prospect until/unless she sells it, but it is an asset that should be included in your capacity rating, just as real estate values are.

- It is conventional wisdom that privately held companies are often not as valuable as publicly traded ones, so as for all the other steps, be conservative in your estimates.

Good luck – and remember: sometimes you just will not have enough information to make a reasonable guess about a company’s valuation and this is not a bad reflection on you or your research skills!