Much of the time we rely on information aggregators like Lexis Nexis or terrific lookup sources through wealth screening companies, but sometimes they misinterpret, or don’t include information from primary sources. So in this week’s article, HBG team member Angie Herrington shares some great advice to help you strategize where to find prospect information directly from primary sources. The added bonus is that many of them are free. ~Helen

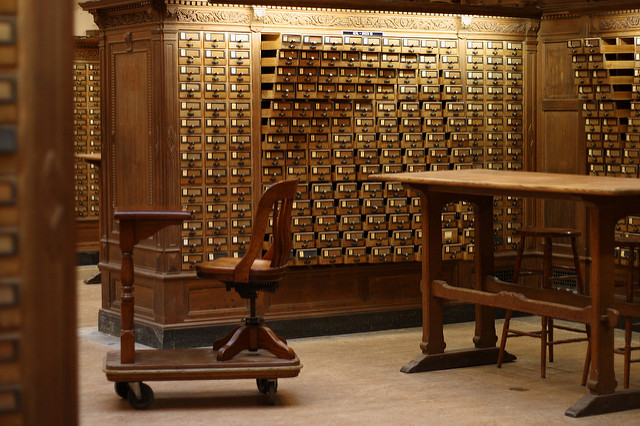

“Card Catalog Sculpture” photo by Sage Ross https://bit.ly/2NLZtPl

In college, I majored in history and was required to take a class on methodology. Holding our blank index cards, our class walked to the university’s library, met with the reference librarian, and then were set free to browse… the card catalog drawers. We were there to learn about historical evidence – primary and secondary sources. [Read more…]