By: Melissa Bank Stepno, President & CEO

For those of us who track trends in philanthropy, June has always been a big month. That’s because it’s typically when Giving USA releases the topline findings of its annual report—though the full version doesn’t arrive until July.

Giving USA is widely considered the most comprehensive source on giving data in the U.S., and as the longest running report it offers unmatched longitudinal data on U.S. philanthropy.

It is the O.G. It is the legacy report. It is the source that everyone relies on.

So much so, that its release sparks a flurry of webinars, blog posts, and analyses from consulting firms and other entities eager to share their take on the headline numbers. That content is out there, so I won’t rehash the details here.

Instead, I want to turn your attention to another important report that dropped just a day after the initial Giving USA stats were released — and it may have flown under your radar.

Introducing the DAF Fundraising Report 2025

Introducing the DAF Fundraising Report 2025

Now in its second year, the DAF Fundraising Report 2025—a collaboration between Chariot and K2D Strategies—is a welcome addition to our philanthropy toolkit.

While Donor-Advised Funds (DAFs) have been around in the U.S. for nearly a century, their influence on the philanthropic sector has surged in the past decade. One reason? There are now roughly 10 times as many DAFs as there were ten years ago.

Since 2012, the National Philanthropic Trust (NPT) has produced the most comprehensive annual report on DAFs, based on data from sponsoring organizations. I rely on it regularly and eagerly await its November release each year. But as valuable as it is, it tells only part of the story.

Until now, we’ve lacked a large-scale report focused on donors who recommend DAF distributions and the nonprofits that receive them.

With the DAF Fundraising Report, we now have our first view into donor behavior, which is fascinating and perhaps more helpful to non-profit organizations looking to understand DAF giving.

Why is this so? And, why do we need so many reports on philanthropy anyway?

Simply stated, every study or report offering trend analysis provides a different lens on the sector, shaped by its data sources.

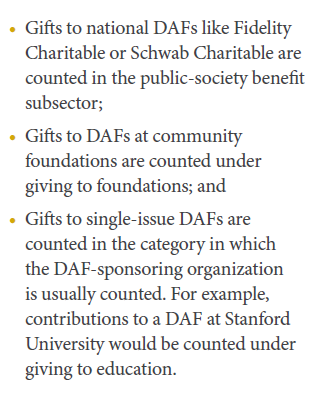

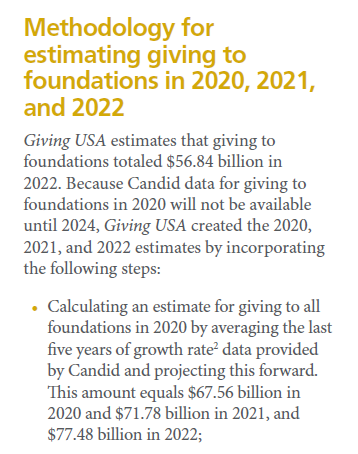

Both Giving USA and the NPT report draw primarily from IRS Form 990s—tax filings submitted by nonprofits. Giving USA supplements this with econometric modeling and other datasets, but ultimately, both reports reflect macro-level trends. They don’t provide insight into donor behavior within individual organizations.

And while the sector has talked about becoming more “donor-centered” since Penelope Burk’s Donor Centered Fundraising came out over 20 years ago, the tools we use to analyze philanthropy haven’t done the same.

The Data Behind the Report

To be clear, I understand the challenges of benchmarking data across nonprofits. From inconsistent gift entry practices to varying definitions of key terms, even basic data can be messy. And some CRM systems don’t make the exporting and reporting process easy. Conversely, IRS 990s offer a standardized (and easier) dataset —but “easy” doesn’t always mean “complete.”

The beauty the DAF Fundraising Report 2025 is that it leverages data provided by nonprofits, directly from their CRM databases, at the donation transaction level. Among other data points, this includes details like an individual donor’s gift dates, amounts and channels (DAF or non-DAF).

To my earlier comments on the challenges with standardizing data, I know that the researchers of this report painstakingly ran quality checks and standardized the best that they could across participating organizations.

While only 32 organizations participated in this year’s report, it is a 60% increase in the number of participants from last year’s report. The participating organizations represented a nice cross-section of sizes (by annual revenue raised), however it should be noted that most participants were from cause-based and/or advocacy organizations, not from other sectors like higher education or health care. As such, my advice would be to use the findings as directional indicators and not absolutes for your specific organization.

Besides its growth in popularity, what makes DAF giving so important to nonprofits?

Let’s just highlight a few of the DAF Fundraising Report’s findings:

- DAF donors have higher retention. On average, they were retained at a rate 13% higher than non-DAF donors.

- Most DAF gifts are not major gifts. In fact, 69% of DAF gifts were under $1,000.

- Donors who switch to DAFs give more. Median giving doubled for donors who converted from non-DAF gifts in previous years to DAF giving.

- DAF gifts are significantly larger. At participating organizations, the median DAF gift was 12x higher than non-DAF gifts.

Closing Thoughts

Though still young, the DAF Fundraising Report 2025 is growing fast—and it’s already walking, if not running. It serves as an important partner for its bigger siblings and I’m hopeful it will continue to evolve, broadening its scope and deepening its insights. In the meantime, I encourage you to take a close look. It offers a rare, donor-level view into one of the most important vehicles in modern philanthropy.