Knowing behind-the-scenes information about the sources we use can help us use them much more efficiently (and/or figure out workarounds). This week I’m delighted to welcome HBG Senior Researcher Heather Willis who shares her knowledge about the tools we use to research nonprofits and foundations. ~Helen

A lot of us research tax-exempt organizations and their 990s on a weekly, if not daily, basis. Lately I’ve been wondering about some of the resources we use for this process and why you can’t always find the information that you’re looking for.

My guess is that maybe you were also wondering, so I decided to look into them more deeply and get some answers. Let’s start with some basics about the Form 990.

The Basics

The PF 990 is a United States Internal Revenue Service form that provides the public with financial information about tax-exempt organizations, including nonprofits and foundations.

According to the IRS, every organization exempt from federal income tax under Internal Revenue Code section 501(a) must file an annual information return unless they qualify as exempt.

Approximately two-thirds of the organizations that are registered with the IRS do NOT file a Form 990 with the IRS in any given year. Whether or not an organization is required to file depends on their gross receipts and total assets. Form 990 must be filed by an organization exempt from income tax under section 501(a) if it has either (1) gross receipts greater than or equal to $200,000 or (2) total assets greater than or equal to $500,000 at the end of the tax year. Read more about the exceptions to this rule here under section A: “Who Must File.”

Filing timing…

Form 990 is due on the 15th of the 5th month after the end of an organization’s fiscal year, with up to 6 months of extensions. So if an organization’s fiscal year ends December 31, then the initial due date for their 990 to be filed is May 15 and the extended due date would be November 15.

And why forms sometimes take so long to show up…

So, an organization could file their 990 ten and a half months after the end of their fiscal year. Some request even longer extensions. And some organizations are unaware that they have to file or possibly even …‘forget’… to file, so you could wait even longer for those reports!

An effort towards transparency

In June of 2016, the IRS began releasing 1.4 million e-filed 990 returns on Amazon Web Services. This effort marks a giant step forward in access to this important public data, as well as, creating transparency, innovation, and an open government. Previously, this Form 990 data dating back to 2011 was only available in image files. This new process unfortunately added delays to the IRS releasing the 990 data in any format. For those who understand how to download and utilize this type of data it could be quite useful; for those of us who don’t, it appears to be a bit tricky.

Under-the-radar reporting requirements

An interesting exchange about foundations occurred in the HBG virtual “office” just the other day: one of my colleagues was searching for a New York-based family foundation’s by-laws in the hopes of discovering the founding donor’s succession plan. My colleague called the Charities Bureau of the NY Attorney General’s office to ask if such information might be publicly accessible.

The foundation’s 990s were readily available via Guidestar or registry search (or iWave or FoundationSearch, etc.), but locating by-laws required an extra step. The attorney she spoke with agreed that such information might be outlined in the registration statements that the foundation was required to file with the Charities Bureau. However, my colleague would need to submit a Freedom of Information Law (FOIL) request but the possible documents could include the foundation’s certificate of incorporation, by-laws, and/or any other organizing documents.

Sometimes we researchers need to re-calibrate our approach to “publicly accessible” information and remember that not everything is on line. This was a perfect example of the importance of digging a little deeper, thinking creatively, and picking up the phone. The procedure for submitting a Freedom of Information request varies by state, but ask the right questions and you’ll be amazed at what you can find …

No 990 or missing attachments and supplemental information??

This topic has come up a few times lately. Occasionally “batches” of 990s that were submitted around the same time to IRS were missing their grants lists. Explanations range anywhere from an increased number in 990s, along with fewer staff to audit and process them, to files becoming corrupt and pages being deleted (!?), to the organization filing extensions for certain sections (or all) of the report. So really, it doesn’t appear there is one good answer. If you come across missing 990s or ones which seem to be missing sections, then here are a few things to try and to keep in mind.

- – Search an alternative source first, especially the organization itself, before you come to any conclusions.

- – Different resources have different criteria; possibly they only house summary type information and not the full report, possibly they just didn’t ask the IRS for that particular 990.

- – Look at the organization’s older 990s to determine their fiscal year. Then look to see if they file extensions often. This will give you an idea of how long you can expect to wait for the most recent report.

- – If you ever have questions while researching you can call the IRS at IRS Tax Exempt and Government Entities Customer Account Services, (877) 829-5500.

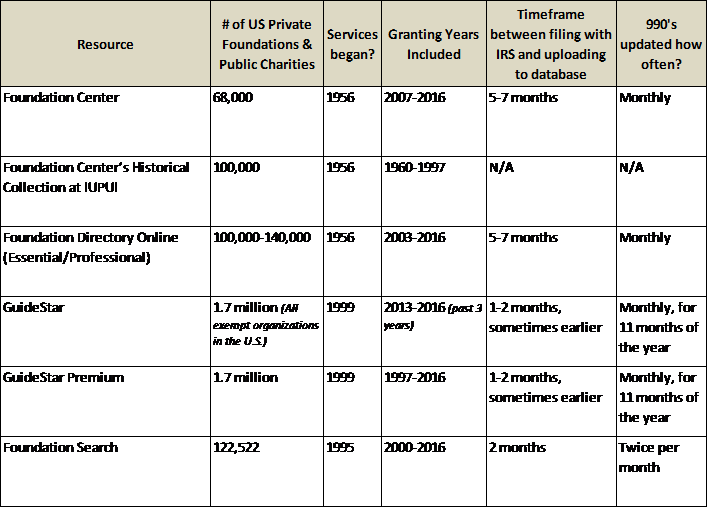

Here are some resource options for researching nonprofits and how they compare…

Resources

Foundation Center (free and $)

The Foundation Center, with over 6 million users per year, provides the 990 Finder or Foundation Directory Online Quick Start as their free online tools, searchable by name, location, EIN, and more. You can find 990s from the last 3-5 years.

The Foundation Center’s subscription product, Foundation Directory Online, also links to 990s. For most grantmakers, you can find 990s for the last 10 years. This database is available by subscription or for free at their libraries and Funding Information Network locations.

To help shorten the lag time, grantmakers can send Foundation Center information on grants electronically as they are awarded. Generally, all grants of over $10,000 are included for all foundations with a total giving amount of at least $5,000,000. Beyond that, an assortment of grants of less than $10,000 are included for these foundations and an assortment of grants of all sizes are included for foundations with a total giving amount of less than $5,000,000. All grants are at least $1,000.

Foundation Search, a business unit of Metasoft Systems Inc., is headquartered in Vancouver, BC and provides a suite of services and products to over 10,000 subscribers. The Foundation Search database can be searched by grant type, value, year, recipient, donor and historical giving trends, and many more. Their database contains all grants valued at $4,000 and above regardless of the organization’s total giving amount giving the user a more accurate and complete analysis of giving trends by geography, categories, giving interests, size of grants, types of grants, granting years and more. Foundation Search’s unique tools include: My Best Prospects, Director Connections, My Foundation Manager, and Power Search.

GuideStar, organized in 1994, began providing the service of online 990s in 1999. Eight million users access an immense amount of data from all exempt organizations in the United States. Any nonprofit in the database can update its GuideStar Nonprofit Profile but GuideStar receives thousands of 990s from the IRS on a monthly basis. Through subscriptions, GuideStar also provides other unique services and products such as analysis tools, reports, platform services, data sets and lists.

Indiana University/Foundation Center Historical Collection

Looking for older 990s and annual reports? Check out the Foundation Center’s Historical Collection housed at the Indiana University Purdue University Indianapolis (IUPUI) University Library. This data on over 100,000 organizations dates back to the late 1950’s, early 60’s. The Center receives 50-100 requests a year to scan upwards of 25,000 pages for various projects that reporters, researchers, and employees of the organizations themselves request.

The IRS also takes requests for 990s. They generally take 4-6 weeks to respond, and may bill you for copying costs.

National Center for Charitable Statistics (free)

The National Center for Charitable Statistics (NCCS), offers its Search 990 Images database, which can be searched by organization name, state, and EIN. The Center is currently undergoing strategic planning and are in the process of designing a new open data platform which will provide a community for nonprofit practitioners, research, and policy-makers to download, create, explore, and share data themselves. As a first step towards this new platform, they have launched the new NCCS Data Archive, which you can find at the following link: http://nccs-data.urban.org/index.php. All files are presented in CSV file format for easy download and access. NCCS is not providing technical assistance or customized data extracts at this time. Furthermore, note that while the NCCS Data Archive will be updated with new data on a rolling basis when available, their previous website (http://nccs.urban.org) will no longer be updated, and they have started to disable links on that site.

ProPublica Nonprofit Explorer (free)

ProPublica, founded in 2007-2008, is an independent, nonprofit, investigative journalism organization. When researching nonprofits, ProPublica’s Nonprofit Explorer offers millions of tax returns from tax-exempt organizations dating back to 2013. You can search by name, EIN, city, state, and narrow down even further by category or organization type. In addition to the raw summary data, they also provide links to PDFs of full Form 990 documents wherever possible.

State records (free or minimal charge)

Web sites of the Secretary of State or Attorney General where the organization is incorporated can provide 990 data. Some states may make 990s and other public documents available online or upon individual request.

The organization Itself (free or minimal charge)

You may also request 990s from the organization directly. Requests made in person must be fulfilled immediately, or within 30 days for a written request, with no charge other than a reasonable fee to cover photocopying and mailing expenses. But check their web site for posted copies, many nonprofits have a section on their website for annual reports and 990s.

Of course, this is not an all-inclusive list, but it should provide a great jumping off point in your search for funders and their 990s.

Another great resource for researching foundations is a video podcast hosted by my colleagues Elizabeth Roma and Helen Brown. If you’re curious about donor advised funds (DAFs), Elizabeth and Helen also discuss finding information about them in the presentation, which is free with registration in the member-only area of our website.