Tara began working in the development field in 2002 at Simmons College in Boston, where she was hired as a major gifts and development research assistant and ultimately went on to serve as Assistant Director of Prospect Research. Later in her career, she worked as a Senior Research Analyst at MIT, as Associate Director of Prospect Management & Research at the Harvard Graduate School of Education, and as Director of Development Research at Combined Jewish Philanthropies (CJP).

Tara originally joined The Helen Brown Group in 2007 as a Research Associate and ShareTraining Coordinator. She rejoined the Group as a Senior Researcher in 2013, and has since gone on to serve as Assistant Director of Research and Consulting; Assistant Director & Data Insight Lead; Associate Director of Research and Consulting; and Director, Research & Consulting, her current role.

She has also been an active volunteer with NEDRA for many years. From 2010-2016, she served on NEDRA’s Board of Directors and was Vice President, Secretary, Editor of NEDRA News, and Chair of the Website & Technology and Volunteer Committees. Since 2020, Tara has been a member of NEDRA’s Research Basics Bootcamp faculty, co-teaching a tri-annual course on the essentials of prospect research. In the past, she was also a volunteer with Apra International, serving stints on the Membership Committee, Chapters Committee, and Bylaws Task Force.

In 2022, Tara received NEDRA’s Ann Castle Award, which acknowledges outstanding effort or achievement in the field of development research and related fields.

She earned a B.A. degree in fine arts, education, and psychology from Smith College.

Tara joined The Helen Brown Group in 2007.

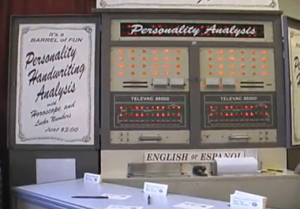

When I was a kid, we went to the Bloomsburg Fair every year, rain or shine. The Fair has been a magical place for generations of kids (no matter their age) and a place of hope as well. It’s been held in late September since 1855, and hundreds of thousands of people come every year for miles around, making it the biggest fair in the Commonwealth of Pennsylvania.

When I was a kid, we went to the Bloomsburg Fair every year, rain or shine. The Fair has been a magical place for generations of kids (no matter their age) and a place of hope as well. It’s been held in late September since 1855, and hundreds of thousands of people come every year for miles around, making it the biggest fair in the Commonwealth of Pennsylvania.

We’ve been dead wrong in our calculations of gift potential for major donors.

We’ve been dead wrong in our calculations of gift potential for major donors. Over the weekend, a friend and fundraising consultant emailed me to ask: “Do you typically see prospects rated for a campaign at 5% of visible assets per year or 5% over 5 years?” I shot back, “Over 5.” He sent back a speedy “thanks!”

Over the weekend, a friend and fundraising consultant emailed me to ask: “Do you typically see prospects rated for a campaign at 5% of visible assets per year or 5% over 5 years?” I shot back, “Over 5.” He sent back a speedy “thanks!”

You need to spring clean your brain – really air it out and get new, fresh ideas in. At least, I know I do. This time of year, I start itching to get out and meet people and learn lots of new things. It’s always worth it when I make the effort.

You need to spring clean your brain – really air it out and get new, fresh ideas in. At least, I know I do. This time of year, I start itching to get out and meet people and learn lots of new things. It’s always worth it when I make the effort. Prospect researchers tend to grab great information sources with the zeal of kids let loose onto the lawn of the White House for the annual

Prospect researchers tend to grab great information sources with the zeal of kids let loose onto the lawn of the White House for the annual