Harbor seal at Magdalen fjord by AWeith (Own work) [CC BY-SA 4.0 (http://creativecommons.org/licenses/by-sa/4.0)], via Wikimedia Commons

Our sector is a whole lot bigger than just the usual suspects prospects.

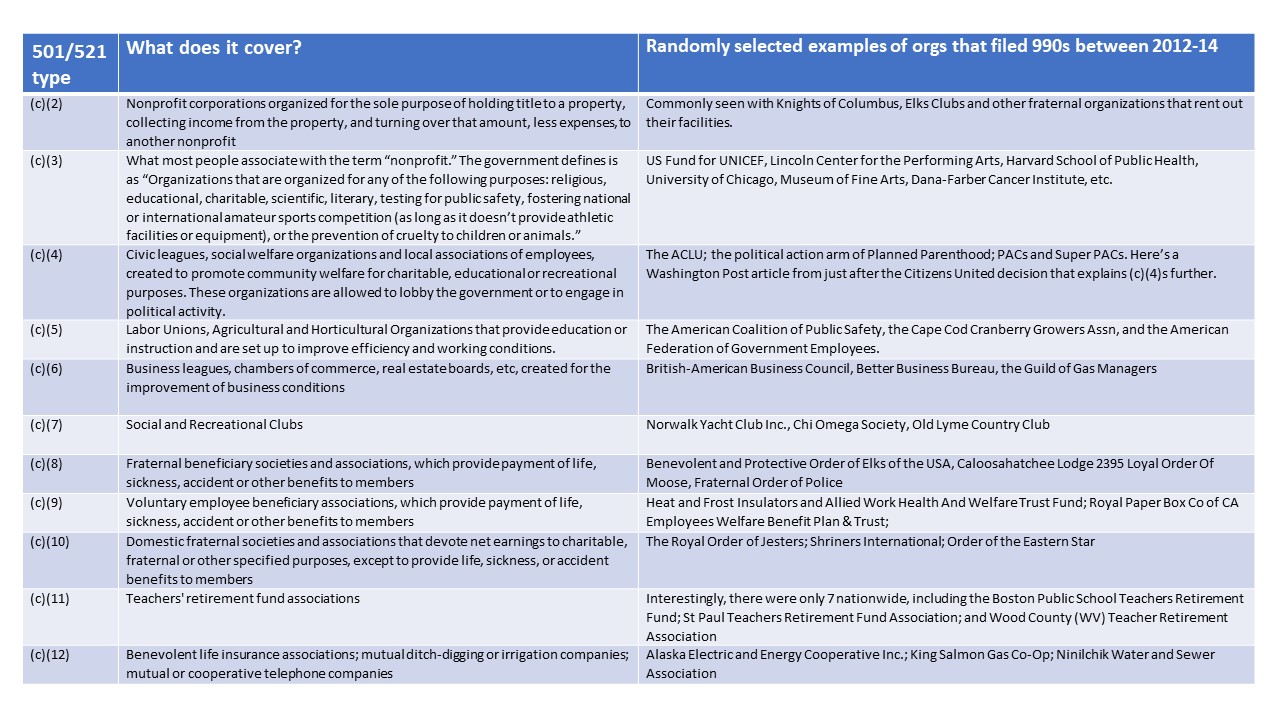

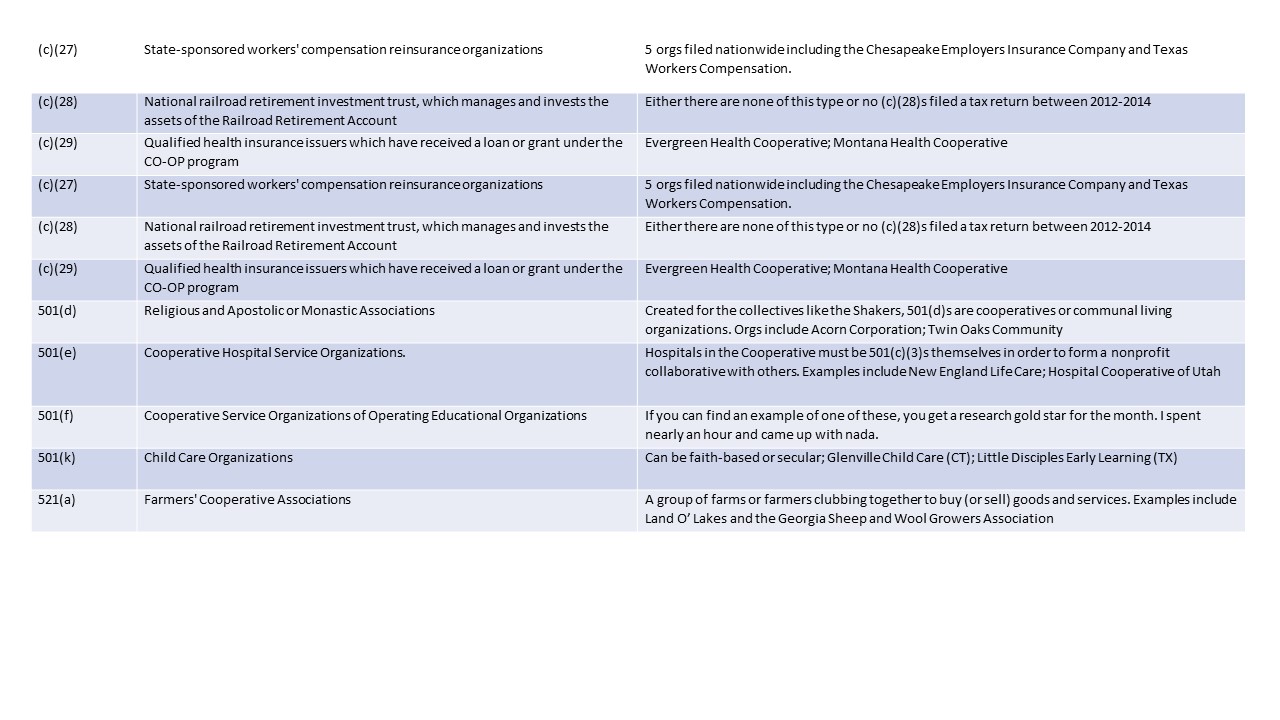

Nonprofits come in many more flavors than just donation receiver, service provider, and donation grantor. There are nonprofit types for associations, clubs, retirement funds…there are even nonprofits you can set up just to hold income property. (More on that after the chart.)

Here’s a list of all of the nonprofit types and who or what they’re meant for (click to enlarge):

Why did I get interested in this topic to begin with?

Well, most of the time when we research people to discover if they have an interest in a cause and the capacity to make a significant gift, we don’t uncover signs of hidden assets, tax evasion, or other potentially concerning behavior.

Seeing as we stick with publicly-available sources, our tools are a bit less sharp than those of our professional cousins in corporate due-diligence, competitive intelligence, law enforcement, and private investigation.

But some time ago I was doing the prospect research version of due diligence on a person who (amongst other things) was the sole board member of a 501(c)(2) nonprofit, which was a nonprofit type I wasn’t familiar with.

So I dug a little deeper and learned that 501(c)(2)s are entities that hold title to one or more pieces of property for the benefit of another nonprofit. So for example, a 501(c)(2) might be the actual title holder for the building where an order of Sons of Italy or group of Masons meet. For all intents and purposes, the lodge belongs to that group, but by putting their building in a 501(c)(2), the lodge can now rent out their building for weddings and bat mitzvahs and receive that income (less expenses) tax free to support their own activities.

Weirdly, though, this person I was researching had their primary residence in the 501(c)(2), and they were renting it out to themselves. The beneficiary nonprofit was the person’s own pension fund.

Now, I’m not an accountant, lawyer, or IRS officer, so I don’t know if that’s actually a violation of tax law, but it seemed at least unusual enough for me to draw attention to it.

Sometimes prospect research and due diligence research can tease out unusual information. You may never need to know all of the different 501(c) organization types or where to get more information. But if a prospect you’re researching has ties to one you’re unfamiliar with, I hope you’ll find this cheat sheet and the resources below to be useful.

For more information on 501(c) organizations

Cornell Law School has a great free online resource detailing nonprofit types (and more) at https://www.law.cornell.edu/uscode/text/26/501

ProPublica has an advanced lookup and resource center for researching all types of nonprofits at https://www.propublica.org/nerds/item/resources-for-investigating-tax-exempt-organizations

Here’s the IRS page on tax-exempt organizations: https://www.irs.gov/charities-non-profits/other-tax-exempt-organizations

The National Center for Charitable Statistics is just an all-around useful site. Here’s the page to search for nonprofit organizations generally and this is a link to their page with a festival of links to further information (such as top ten lists, reports, whitepapers, etc.).

And no list would be complete without Guidestar, of course: http://www.guidestar.org